Friday, February 10th, 2023

Highlights

isolved version 9.02 includes Open Enrollment menu changes, a new look for the Jobs page, a redesign of labor selection in AEX, additional updates to federal and state withholding forms, Applicant Tracking enhancements, an update to Arizona withholding tax rates, plus a final sneak peak of the Benefit Reconciliation Utility.

Applicant Tracking

- Job numbers allowed in Job Board Job Title field on the Job Listings form

- Text to Apply now includes job location as part of the job title

- Refer.io Opt-in at Quick Apply

- eForm data now available in Report Builder

- Requisitions now shows audit information related to changes

- Reinitiate a denied requisition

- User notification upon applicant status change

Benefits

- Open Enrollment menu options changing to Benefit Enrollment

- New Benefit Reconciliation Utility is coming soon

HR

- Jobs page redesigned to display key employee job information in the forefront

Onboarding and Employee Self-Service (ESS)

- Updated 2023 tax withholding forms in the Tax Wizard

Payroll

- Employees required to complete a new Form A-4 by first payroll in March to avoid default 2% Withholding

Time and Labor Management

- Redesign of labor selection in Adaptive Employee Experience (AEX)

Applicant Tracking

Newly released features and updates

Job numbers allowed in Job Board Job Title field on the Job Listings form

We will once again allow numbers within the Job Board Job Title field on the Job Listings form. We do not recommend using numbers in the job title field. Doing so will limit your job’s visibility on Indeed and other job boards. All pay information should be included in the job ad to avoid hurting your job’s visibility on the job boards.

Text to Apply now includes job location as part of the job title

To help Text to Apply applicants apply to the job best suited for them, the job location is now visible as part of the Job Title. Example, applicant applying to a cashier position in Salt Lake City, UT will see “Cashier (Salt Lake City, UT)”.

Refer.io Opt-in at Quick Apply

Refer.io is one of the top sources for applicants. We now allow applicants to opt-in to receiving email notifications about new job openings at your company when they apply through the Indeed quick-apply process. In doing so, Refer.io can automatically notify your current talent pool of other job openings within your company as they become available.

eForm data now available in Report Builder

We’ve added eForm data as an option within the Report Builder. You can create custom reports that include data from your eForm fields.

Requisitions now shows audit information related to changes

When information on a Requisition is changed, the name of the user who changed the information will now show along with the date and time.

Reinitiate a denied requisition

Administrators now can reinitiate a denied Requisition. You can make changes to the denied requisition, and it will go through the approval process again with an email stating the eForm needs to be approved again. A version history will be created for reference.

User notification upon applicant status change

You can now set-up your application statuses to automatically notify users via email when that status is assigned to an applicant.

Benefits

Benefit Menu Option Changes

Open Enrollment renamed Benefit Enrollment

The Menu item that is located under Client Management > Benefits > Open Enrollment Setup has been renamed to Benefit Enrollment Setup. The Menu item in Employee Self-Service Class View for Open Enrollment has also been renamed to Benefit Enrollment.

Benefit Reconciliation Utility – coming soon

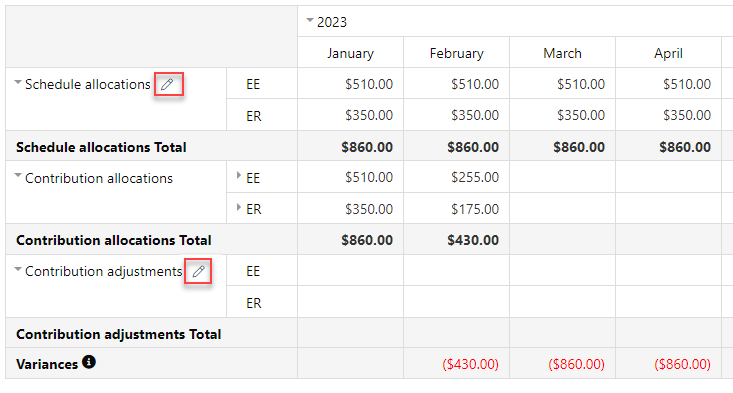

Updates to the employee Benefits screen and Benefit Reconciliation Utility functionality

Users with full access to the benefits module will have the ability to modify the Schedule allocations as well as adjust contributions on the employee’s Benefits screen.

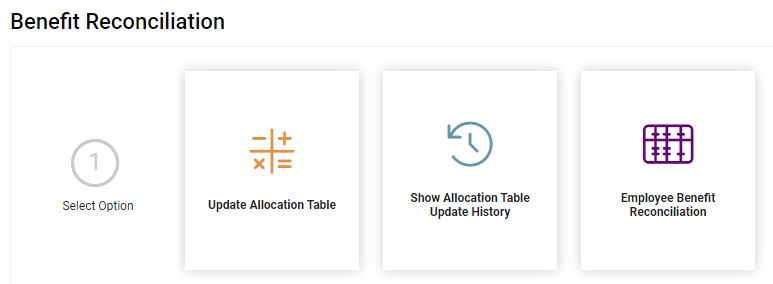

The Benefit Reconciliation screen will include functionality to include a mass update of the allocation tables and a way to show the history of the mass updates:

- Update Allocation Table – This function creates a mass update of all employee’s allocation tables at one time for one or more benefit types or plans. This could be needed if you have made updates to the Scheduled Premium Rules or for employees who do not yet have updated allocation tables.

- Show Allocation Table Update History – This option will display the history for updates going back one year from the current date.

- Employee Benefit Reconciliation – This utility will help you identify and manage any discrepancies between the billed amount and payroll amounts for benefits. When you select this option, you are prompted to select a date range, legal company, pay group, and can select “variances only” to easily identify employees with discrepancies between the scheduled and contribution amounts.

HR

Jobs page redesign

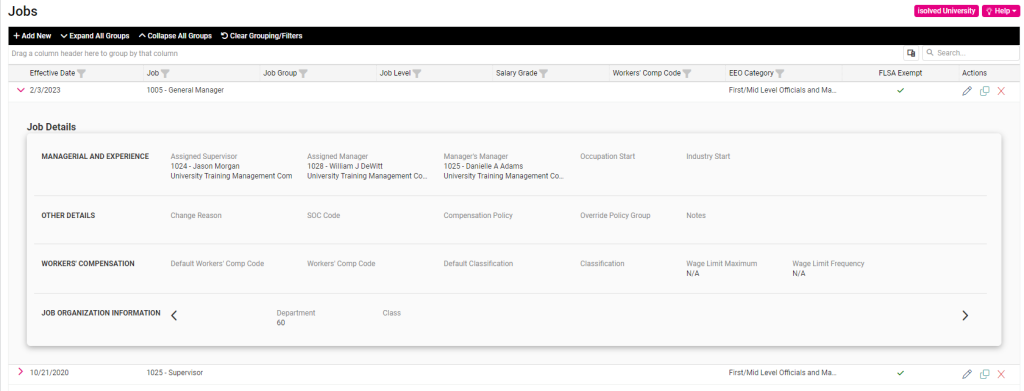

New Job Details card displays key employee job information

The new Job Details card displays current employee job details without a single click of a mouse. The Job Details card is available for all jobs an employee has had but will default to display in expanded form for an employee’s current job.

Onboarding and Employee Self-Service (ESS)

Updated 2023 tax withholding forms in the Tax Wizard

Additional updates to ensure compliance with the latest federal and state withholding forms

Additional federal and state tax forms have been updated in the Tax Wizard in Onboarding and Tax Updates in both Classic View and the modern Adaptive Employee Experience (AEX). The following forms have been updated to support 2023 requirements:

- Federal W-4(SP) – Certificado de Retenciones del Empleaado (Spanish-language version of the Employee Withholding Certificate)

- California DE 4 – Employee’s Withholding Allowance Certificate

- Maryland MW 507 –Employee’s Maryland Withholding Exemption Certificate

- Michigan GRW-4 – Employee’s Withholding Certificate for Grand Rapids Income Tax

- Mississippi 89-350 – Mississippi Employee’s Withholding Exemption Certificate

- Rhode Island RI W-4 – Employee’s Withholding Allowance Certificate

Payroll

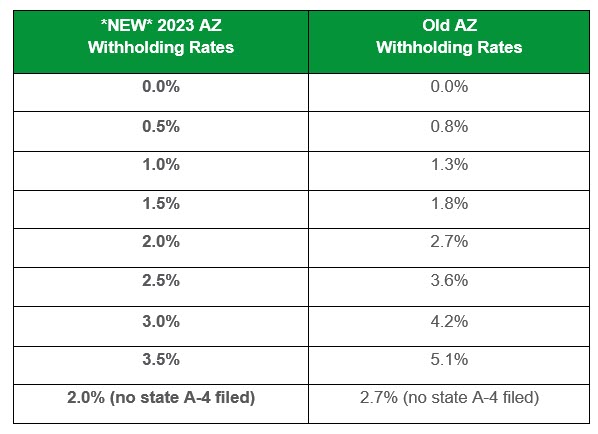

Arizona reduced withholding tax rates

Employees required to complete a new Form A-4

Expired rates are now marked as “inactive” and will not be displayed on any screens which give the user the option to select an alternate calculation. The Tax Information screen will continue to display inactive codes, but only allows active codes to be selected.

Every Arizona employer is required to make the new Form A-4 available to its Arizona employees by January 31, 2023. Tax screens may still display old rates for employees who have not yet completed a new Form A-4 and those employees’ state tax will still calculate based on the old percentage. If an employee still has an old state withholding tax rate on the first payroll in March, their state withholding will be calculated using the default rate of 2% until they complete a new Form A-4. Please have all employees who have Arizona withholding taxes fill out a new 2023 Form A-4 to ensure the proper tax is withheld.

For more information about Arizona’s withholding tax changes, visit Arizona’s Department of Revenue website.

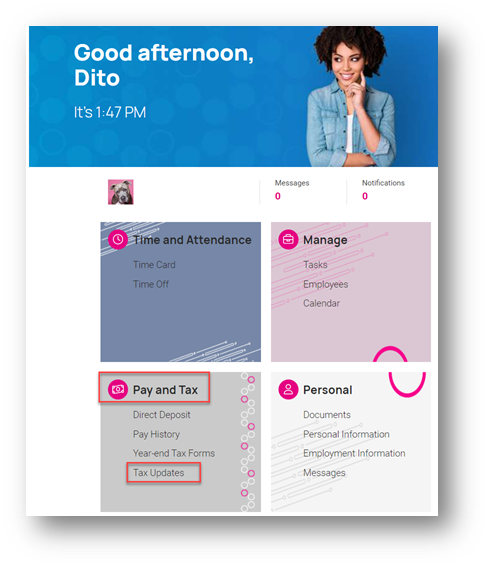

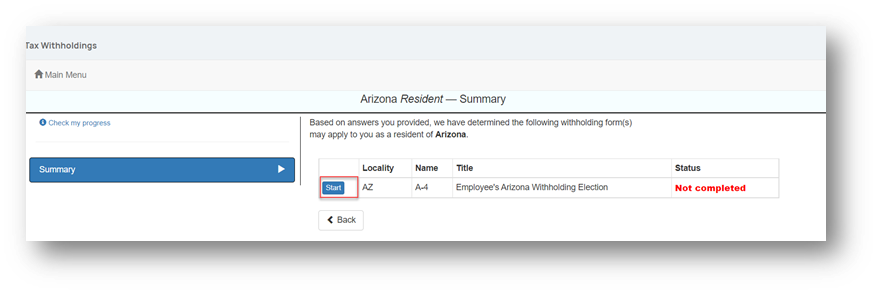

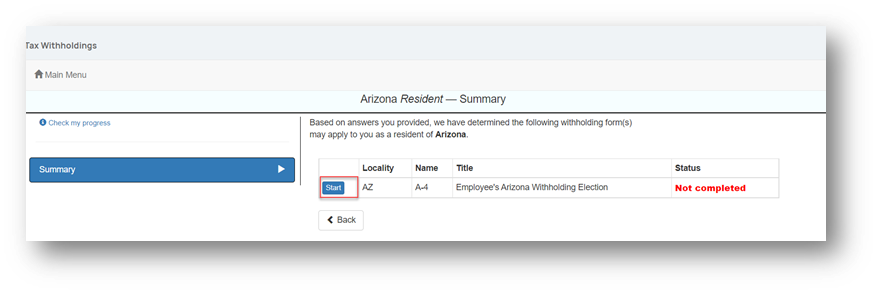

Employees can easily complete the A-4 form within isolved:

For those clients taking advantage of the modern Adaptive Employee Experience (AEX), employees can create a new A-4 by selecting the Tax Updates option.

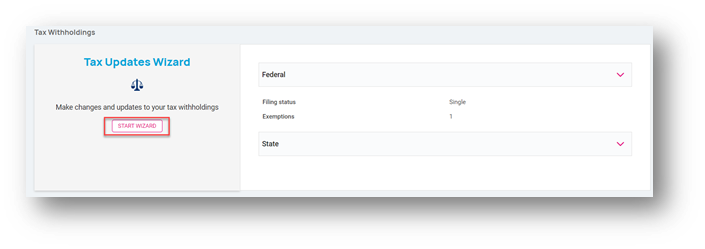

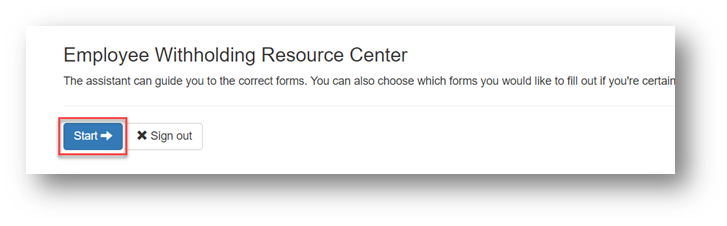

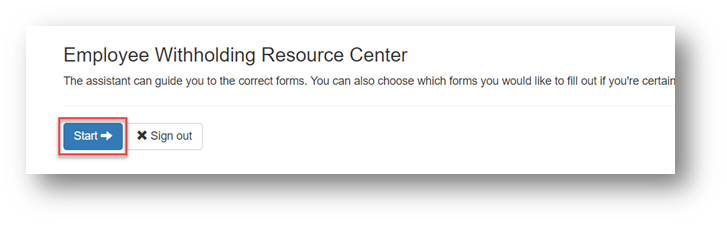

Within the Tax Updates page, the employee may access the A-4 by selecting the Start Wizard button and then clicking the blue Start button on the Employee Withholding Resource Center page that follows.

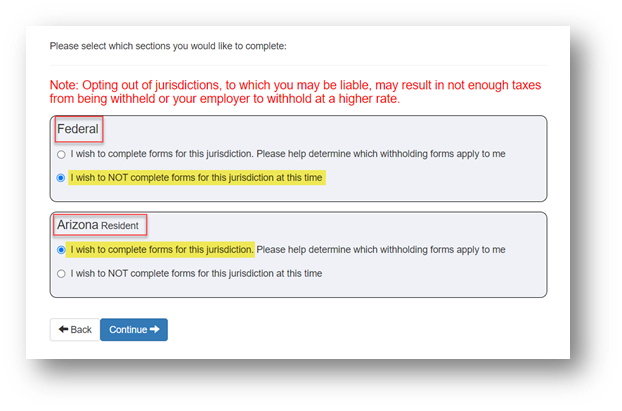

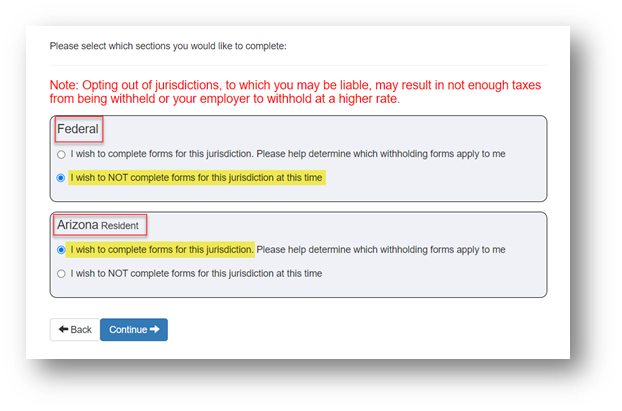

If the employee is only going to create a new Form A-4, they would select the “I wish to NOT complete forms for this jurisdiction at this time” under the Federal forms section of the screen. The “I wish to complete forms for this jurisdiction” option defaults to selected for the Arizona Resident section of the screen. Clicking on the blue Continue button will lead the employee through a series of questions to confirm the A-4 form applies to their situation and allow them to complete the A-4 form by clicking the blue Start button.

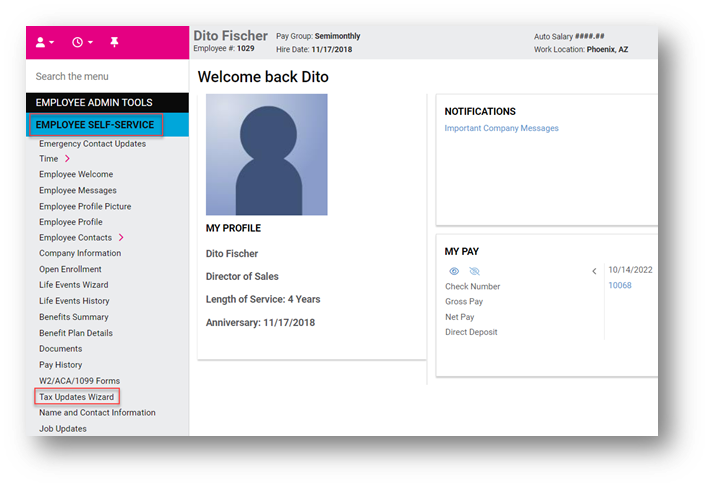

For those clients who remain on the Employee Self-Service Classic View, employees can create a new Form A-4 by selecting the Tax Updates Wizard menu option within the Employee Self-Service menu and then selecting the Start button on the Employee Withholding Resource Center page.

If the employee is only going to create a new Form A-4, they would select the “I wish to NOT complete forms for this jurisdiction at this time” under the Federal forms section of the screen. The “I wish to complete forms for this jurisdiction” option defaults to selected for the Arizona Resident section of the screen. Clicking on the blue Continue button will lead the employee through a series of questions to confirm the A-4 form applies to their situation and allow them to complete the A-4 form by clicking the blue Start button.

Time and Labor Management

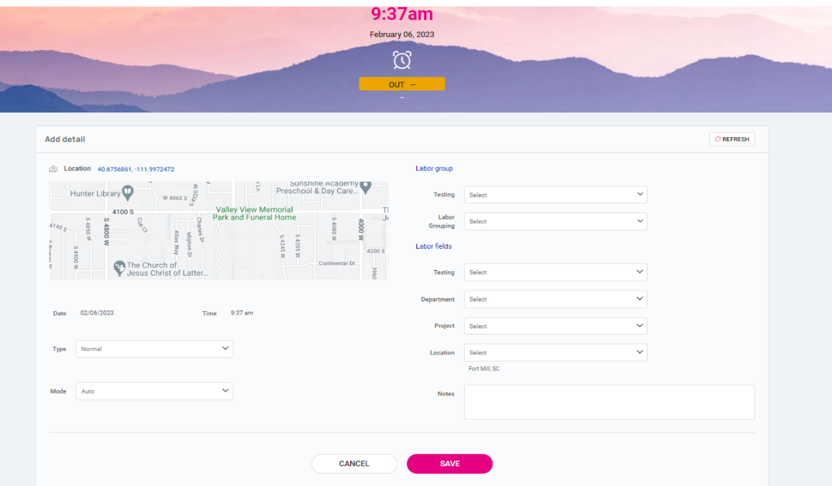

Remodeled labor selection functionality in AEX

Improved usability for employees, supervisors, and managers

The labor selection functionality in isolved has been remodeled in the Adaptive Employee Experience (AEX) to improve usability. The selection of Labor Groups will function as a filter to populate default Labor fields. The Labor Group and associated Labor fields will include a dynamic search feature. The display will list the code and the description for the labor item(s). If an employee has any default labor fields, when the screen loads, the labor fields will display below the labor field box. The employee will be able to see what the default values are and can make any changes by selecting the override value in the Labor field section.

This update will impact the Speed dial for the Detail Punch and Missing Punch. For Managers/Supervisors, this will impact the Create New Punch, Create New Hours, and Create New Adjustment. Group Punch will also have the remodeled functionality, but default Labor is excluded due to multiple people being included in the group punch. For Employees this will impact the Add New Punch, Add New Adjustment and Add New Hours.

For more information about the changes in the version 9.02 release, contact your Payroll Specialist.

Download the release notes

Download the release notes: isolved Product Release v9.02