Friday, February 24th, 2023

Highlights

isolved version 9.03 includes important information about tax documentation requirements, information about our new integration with TurboTax, updates to PA local tax names, new MyMDSavings reports, an update to the I-9 Dashboard, resolution to an error caused by some comp time plans, Applicant Tracking enhancements, and a reminder about the March deadline for the new Arizona withholding tax rates.

Applicant Tracking

- Pay details required for New York, Washington, Colorado, and California

- Adzuna Quick Apply integration

- Updates to Jobs and Job Detail page capabilities

- Indeed ATS to Indeed employer account connection

- Notify user upon Job Listing opening

- Locations on the WordPress Career Site plugin

- Job Board library search

- XML Jobs feed

- Calendar scheduling integration – third party interviewing options

- Reorder tabs when viewing an application

- isolved – Single Sign On

- New GoodJob integration

HR

- Update to the I-9 Verification Dashboard

- Name change for various PA local taxes

- New client reports for Maryland’s state mandated MarylandSaves program

- TurboTax integration makes tax filing easier in 2023

- New Self-Service menu option for access to TurboTax in Classic View

- 2% default withholding rate will apply if Arizona employees so not complete a new Form A-4 before the first payroll in March

Payroll

- Tax documentation requirements for IRS and state notifications – important

Time and Labor Management

- Comp time plans causing issue viewing time off information – resolved

Applicant Tracking

Applicant Viewer

Reorder tabs when viewing an application

You can now reorder tabs when viewing an application within the Applicant Viewer, so you can arrange them in an order that makes the most sense to your company’s hiring process. Any user with access to view applicants can reorder the tabs. The tab order is for the entire Applicants View, it is not user specific.

Career Site

Career Site Page Updates to Jobs and Job Detail page capabilities

We can include your JavaScript on your career site that will show on the Jobs pages but will not show on the application. This can be used for many things such as chatbots, images, and videos that you want the applicant to see when they land on your career site. Are you working with a 3rd party and would like the ability to add an applicant chat script to track specific information on the Jobs or Job Detail page? Contact support@isolvedhire.com and we can add your JavaScript on the Career Site Jobs and the Job Detail page headers to enable this functionality.

Locations on the WordPress Career Site plugin

Currently, when using WordPress to manage your career site, the location presented on your site is the Job Ad Location. The Job Ad Location is sometimes used to market your job to candidates in other areas and isn’t the best representation for the job location on your career site. We are automating all WordPress sites to include the Job location instead of the Job Ad Location. If you choose to represent the Job Ad Location, you can do so by toggling off “Show Job Location” in the WordPress Settings. If this is toggled off, applicants will see the Job Ad Location for your jobs.

Integrations

Indeed ATS to employer account creation

To improve tracking for our Sponsored Jobs Integration (SJI) with Indeed, we have changed the account connection from a company level connection to an individual user connection. Your users may be prompted to reconnect their isolved Applicant Tracking account to their Indeed account through our robust Indeed Sponsored Jobs Integration. Please note that your users must be an Admin level user with posting rights on Indeed for them to successfully connect and sponsor via the integration.

New GoodJob Integration

We now have integration between the isolved Applicant Tracking and GoodJob for clients who use GoodJob for their hiring assessments. The new integration will initiate in isolved Applicant Tracking and scores and reports will show there once a candidate completes their assessment.

isolved – Single Sign On

You have already been enjoying the single sign on functionality that allows you to easily move from isolved People Cloud to isolved Applicant Tracking. Now you also can single sign on from the isolved Applicant Tracking to isolved People Cloud allowing for navigation between the solutions to be more streamlined. Contact support@isolvedhire.com to enable this feature.

Calendar scheduling integration – third party interviewing options

We have added several new integrated options to conduct online interviews using your personal or business accounts with Indeed, Zoom, Microsoft Teams, and GoToMeetings when utilizing the interview scheduler within isolved Applicant Tracking. You can now click to “Schedule a Calendar Event” and the interview will be set up.

Job Board

Job Board library search

We have updated the Job Board Favorite search area with a URL search to help you easily find your favorite job boards. We have also added a check to verify the right job board is already available within the library when you request to add a new job board.

XML Jobs feed

For our clients utilizing the XML Jobs feed, we have added the Job Status field to the feed for you to use as desired.

Job Listings

Pay details required for New York, Washington, Colorado, and California

California, Colorado, Washington, and New York have laws in effect or going into effect soon, that require employers to list pay rate or pay ranges on their job listings. Job boards like Indeed are limiting visibility on jobs where the state law is not being followed. In order to protect the job seeker traffic you get on your jobs from the job boards, we now require pay to be listed on a job listing if he job location or job board advertising location has one of those specific states selected.

Adzuna Quick Apply integration

We now have Quick Apply integration with the job board Adzuna. Applicants can find your jobs on Adzuna and apply to your jobs without leaving the Adzuna platform. These applications will come through based on your account’s Quick Apply settings. If you have any questions about how your account is set up, please support@isolvedhire.com.

Notify user upon Job Listing Opening

You now can select multiple users to receive an email notification alerting them that a Job Listing has been opened. This notification is triggered based upon the “start date” of the Job Listing.

HR

Update to the I-9 Verification Dashboard

Passport expiration dates no longer display on Reverification tab

Reverification of a US citizen or non-citizen national is not required so the I-9 Verification Dashboard has been updated to not display the expiration dates for passport documents.

Payroll

Important – Tax documentation requirements

IRS and State Notifications

Unemployment rates and tax filing frequencies are mailed to the taxpayer, and it is imperative that these tax-related communications are forwarded to your Insperity payroll specialist immediately. We require this information to ensure your taxes are paid accurately and timely.

Please note: Late tax payments result in interest and penalty charges. If your federal and/or state filing frequency is changed and you do not notify us, we will not be responsible for any penalties or interest that may be charged.

Name Change for various Pennsylvania local taxes

Tax names change to comply with a new tax naming convention

Pennsylvania taxes that were previously named as an Occupational Privilege Tax (OPT) have been updated to comply with a tax name change to Local Services Tax (LST).

MarylandSaves state mandated savings program

New Client Reports available to support MarylandSaves

The following Client Reports have been added to allow the export of MarylandSaves data from isolved:

- MD Retirement Savings – Contributions FTP

- MD Retirement Savings – Initial Census

- MD Retirement Savings – Ongoing Census FTP

These reports will provide you with the information you need to provide the state with your original employee information during registration (MD Retirement Savings – Initial Census) as well as the ongoing requirement to provide employee information (MD Retirement Savings – Ongoing Census FTP). The MD Retirement Savings – Contributions FTP will export MyMDSavings deduction information from isolved. Please visit the MarylandSaves website for additional information on the plan.

TurboTax integration makes tax filing easier in 2023

Importing your W-2 in TurboTax is easy

Employees can save time and have more accurate personal income tax returns using Insperity Workforce Acceleration (WX) and TurboTax. When they file their 2022 tax year returns, they can import their year-end form information directly into TurboTax. See the TurboTax integration article in the Help Center for additional information.

New Self-Service menu option for access to TurboTax in Classic View

Employees can access TurboTax directly from self-service

You can now enable your employees to access the Intuit website to login to/purchase TurboTax directly from their Self-Service menu when in Classic View. If you are interested in enabling this menu options, please contact your Payroll Specialist for assistance.

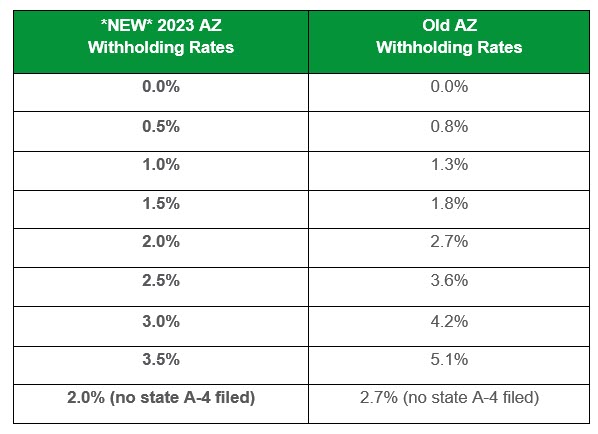

Arizona reduced withholding tax rates

2% default rate will apply if employees have not created a new A-4 before the first payroll in March

Every Arizona employer was required to make the new Form A-4 available to its Arizona employees by January 31, 2023. If an employee still has an old state withholding tax rate on the first payroll in March, their state withholding will be calculated using the default rate of 2% until they complete a new Form A-4. Please have all employees who have Arizona withholding taxes fill out a new 2023 Form A-4 to ensure the proper tax is withheld.

For more information about Arizona’s withholding tax changes, visit Arizona’s Department of Revenue website.

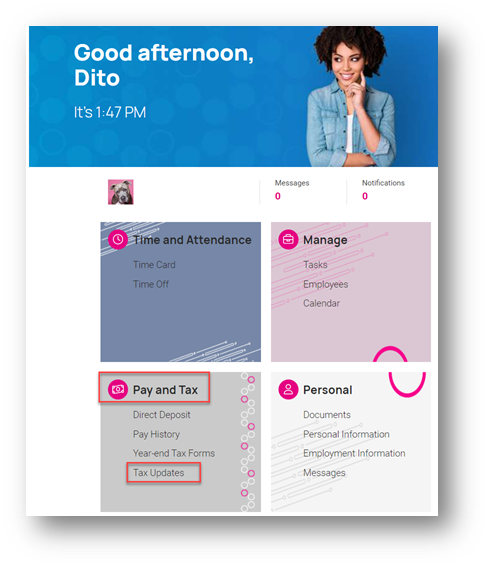

Employees can easily complete the A-4 form within isolved:

For those clients taking advantage of the modern Adaptive Employee Experience (AEX), employees can create a new A-4 by selecting the Tax Updates option.

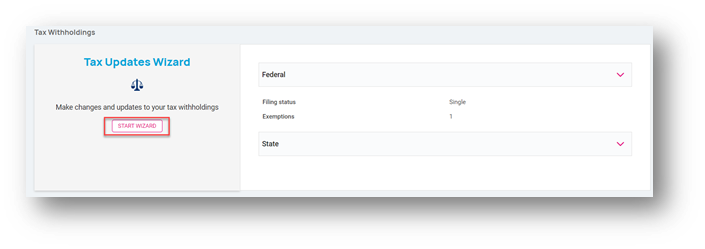

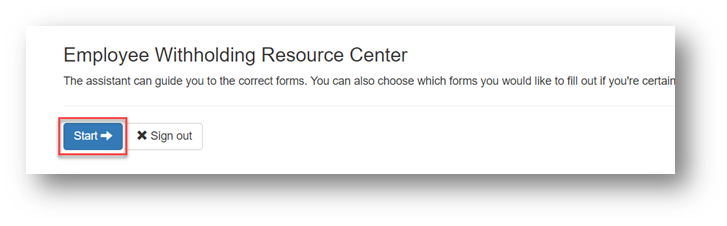

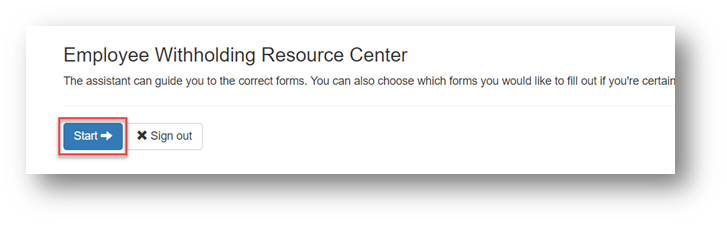

Within the Tax Updates page, the employee may access the A-4 by selecting the Start Wizard button and then clicking the blue Start button on the Employee Withholding Resource Center page that follows.

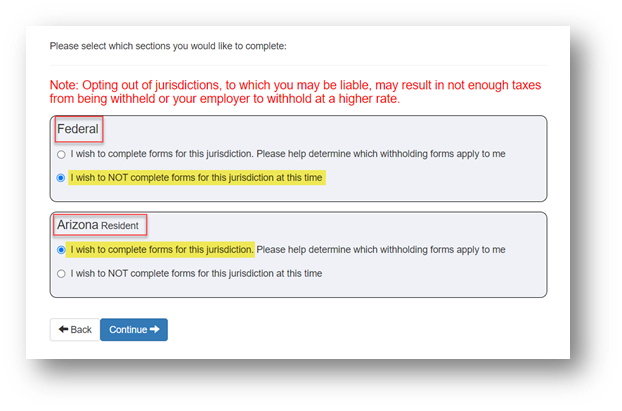

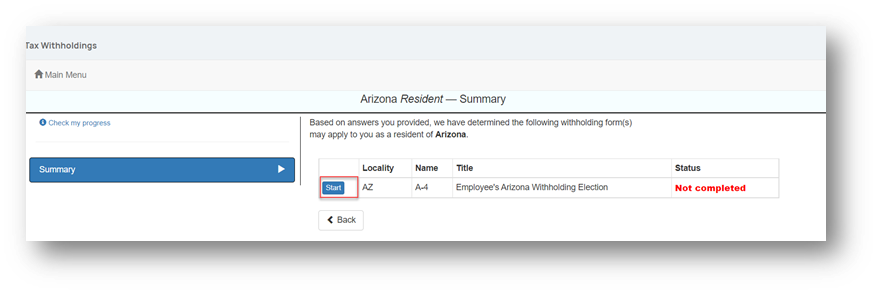

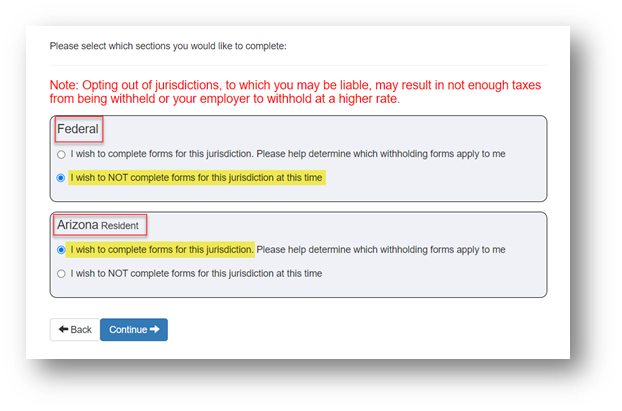

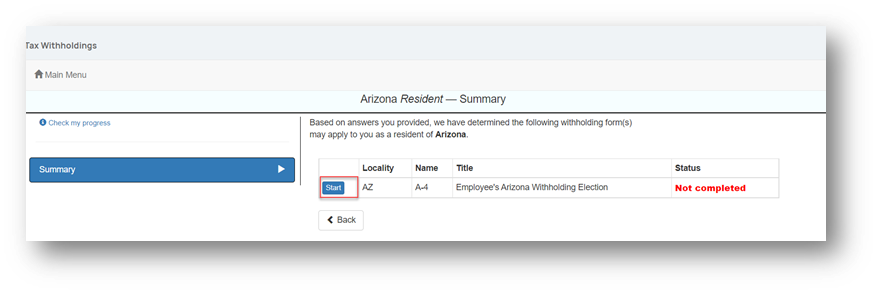

If the employee is only going to create a new Form A-4, they would select the “I wish to NOT complete forms for this jurisdiction at this time” under the Federal forms section of the screen. The “I wish to complete forms for this jurisdiction” option defaults to selected for the Arizona Resident section of the screen. Clicking on the blue Continue button will lead the employee through a series of questions to confirm the A-4 form applies to their situation and allow them to complete the A-4 form by clicking the blue Start button.

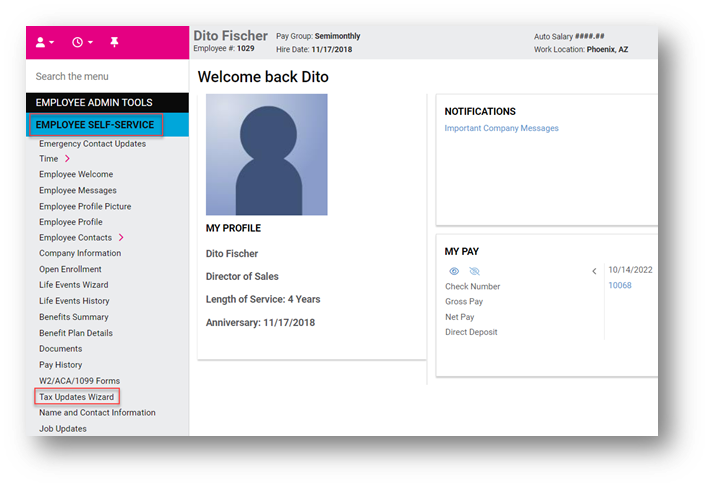

For those clients who remain on the Employee Self-Service Classic View, employees can create a new Form A-4 by selecting the Tax Updates Wizard menu option within the Employee Self-Service menu and then selecting the Start button on the Employee Withholding Resource Center page.

If the employee is only going to create a new Form A-4, they would select the “I wish to NOT complete forms for this jurisdiction at this time” under the Federal forms section of the screen. The “I wish to complete forms for this jurisdiction” option defaults to selected for the Arizona Resident section of the screen. Clicking on the blue Continue button will lead the employee through a series of questions to confirm the A-4 form applies to their situation and allow them to complete the A-4 form by clicking the blue Start button.

Time and Labor Management

Comp time plans

Issue viewing time off balances resolved

Some clients with comp time plans were experiencing an issue when attempting to view time off balances. This issue has been resolved.

For more information about the changes in the version 9.03 release, contact your Payroll Specialist.

Download the release notes

Download the release notes: isolved Product Release v9.03