Friday, July 14th, 2023

Highlights

isolved version 9.13 makes it easier to manage rates for union and prevailing wage clients. More isolved People Cloud screens have the modernized look with this release, and you can now select subcategories when uploading documents in the Adaptive Employee Experience. There are changes to the isolved Benefit Services COBRA client portal and Indeed job board fee changes with Applicant Tracking too. Disability self-identification in self-service has been updated to meet compliance requirements.

Payroll & Tax

- You can now use employee labor assignments to calculate union dues, fringe benefits, and other pay items

- Retroactive tax changes to HSAs for New Jersey income tax and the Scranton, PA Employer Payroll Expense Tax

- A new employee tax exemption code has been added for the Washington CARES Fund

Benefit Services

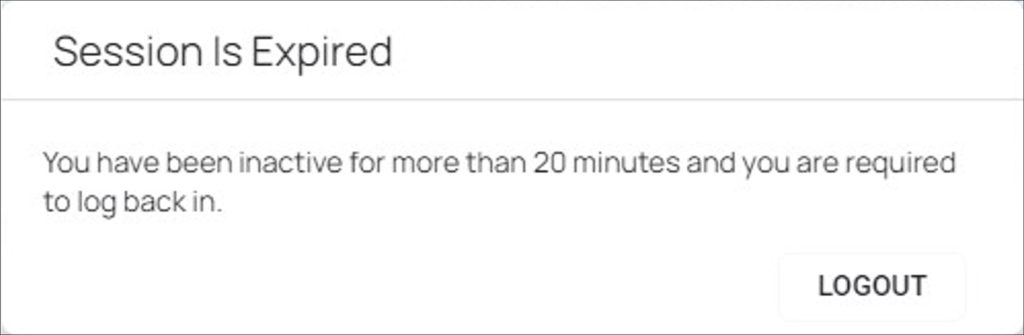

- For added security, users who have been inactive for 20 minutes will be automatically logged out of the COBRA Client Portal

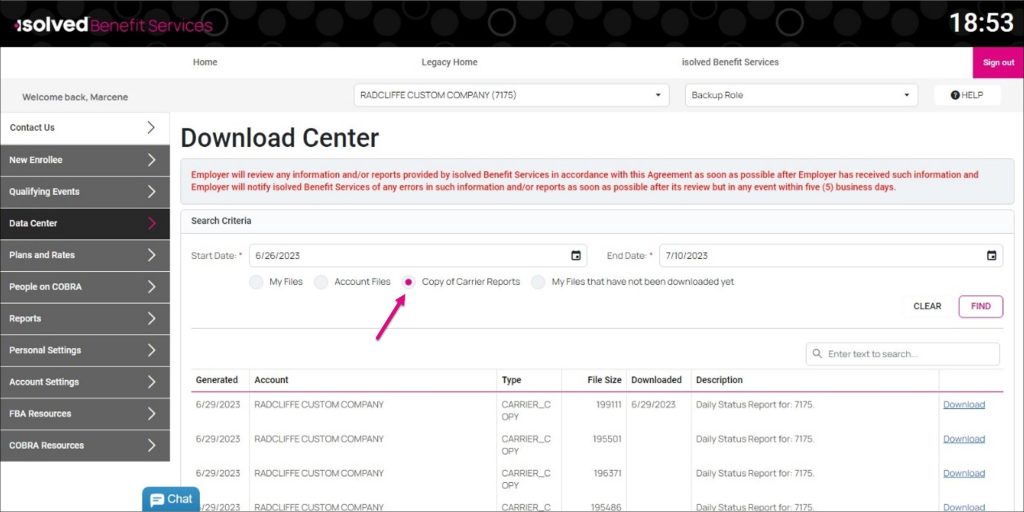

- You can review copies of your carrier reports again in the Download Center in the COBRA Client Portal

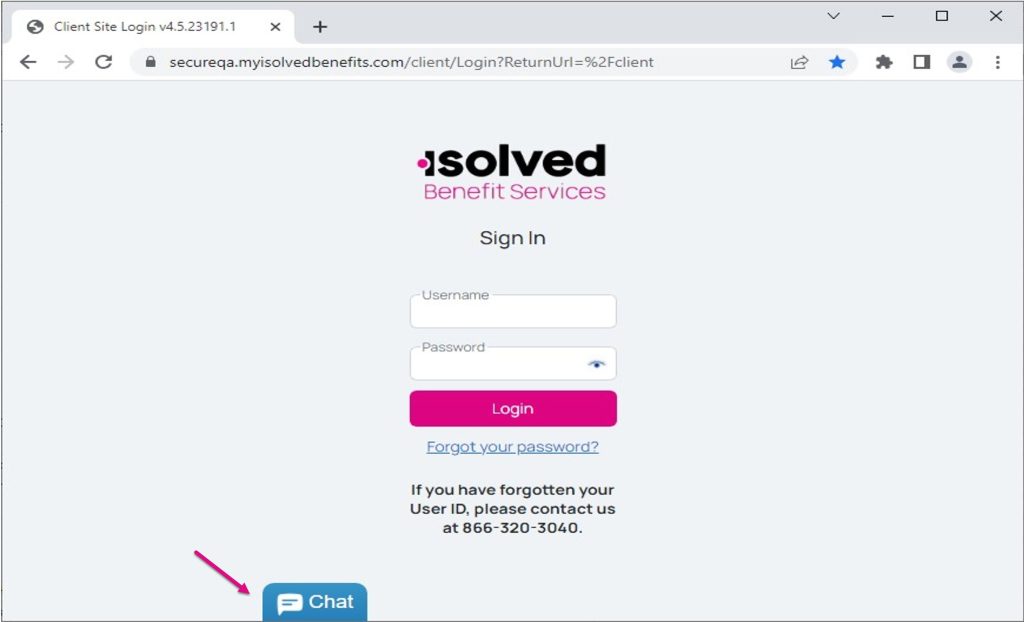

- Benefit administrators can access chat right from the COBRA Client Portal login page

Applicant Tracking

- Indeed has changed its fee structure so you will only pay when applicants start an application, saving you money

- The Twilio changes outlined in the version 9.10 release are rolling out to clients using the Text-to-Hire feature in mid-July

- A client newsletter is launching soon to keep you updated on Applicant Tracking best practices, so keep an eye on your inbox

HR & Performance Management

- The Performance Review Ratings screen has the modern grid view with options to search and see more information at a glance

- The Notes screen for client administrators gets a refreshed look to make it easier to sort and filter the list

- The Employee Contacts list in the Human Resources section of Employee Management has been updated with the searchable grid view

Reporting

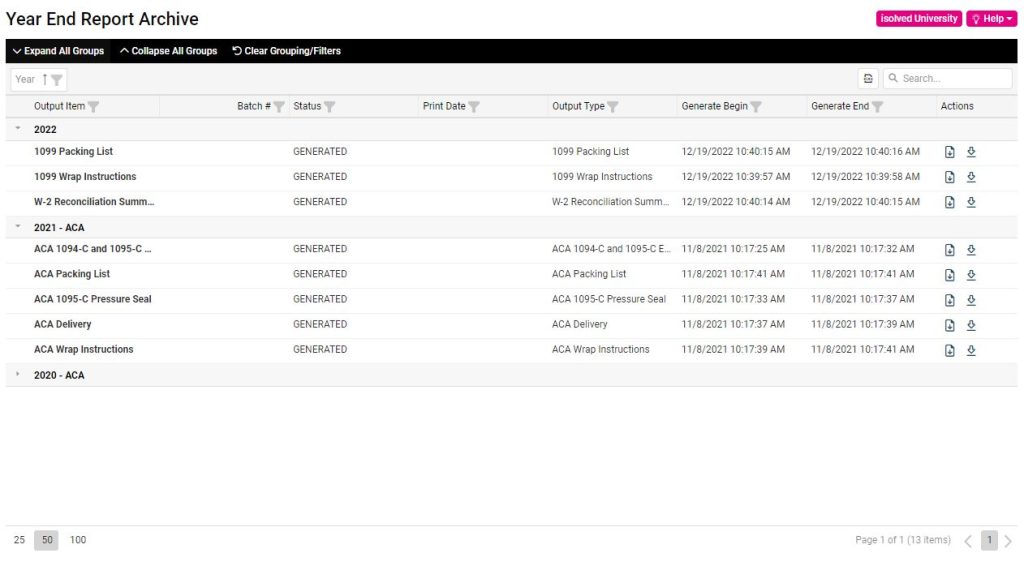

- Find reports more easily in the updated Year End Report Archive

Self-Service

- When employees complete their I-9 during onboarding in the Adaptive Employee Experience, extra spaces before and after the employee’s name will be automatically removed so there are fewer issues authenticating when they electronically sign

- When employees voluntarily self-identify disability information in Onboarding and the Adaptive Employee Experience (AEX), the verbiage has been updated to use the OFCCP preferred language so government contractors can implement the new form by the July 25, 2023 deadline

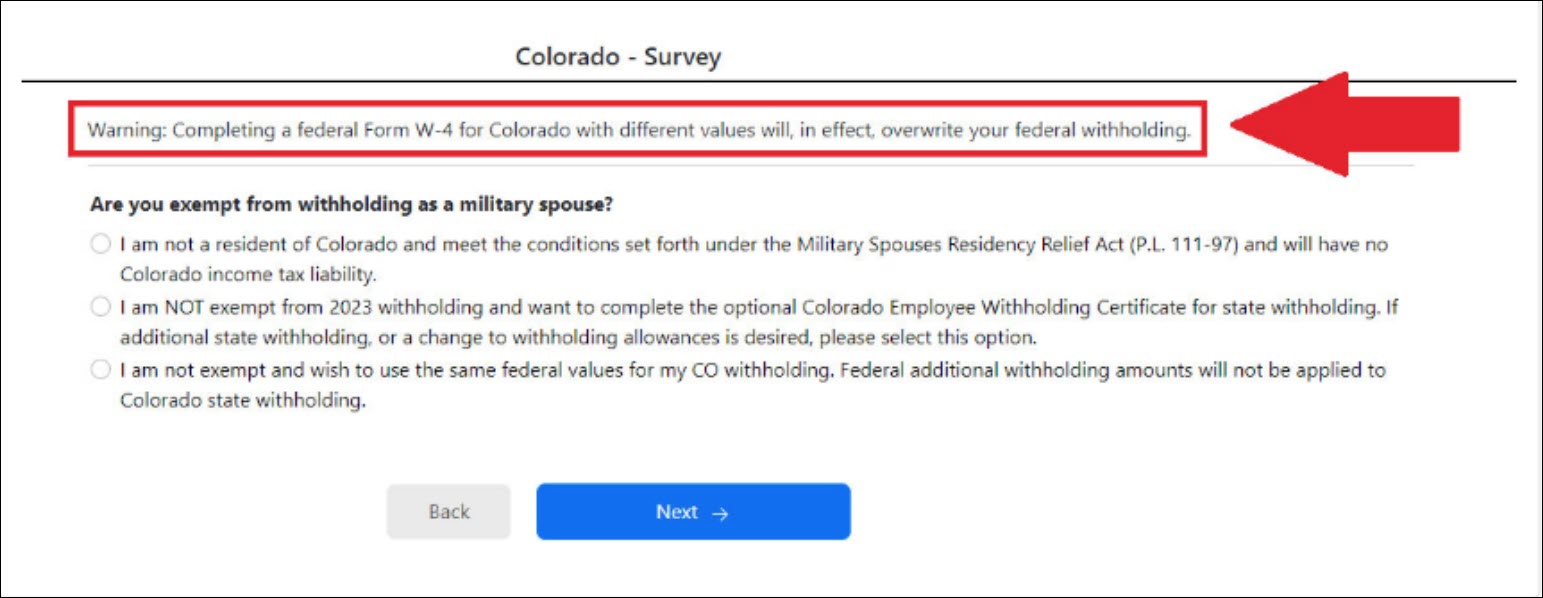

- Tax compliance updates have been made to employee withholding forms in the Tax Wizard in Onboarding, ESS Classic View, and the Adaptive Employee Experience (AEX)

- Better screen design makes it easier for managers, and supervisors to view their employee’s salaries in ESS Classic View

Identity Management

- Most users have been successfully migrated to the new People Cloud account that combines access to all your isolved roles in one simplified login. We appreciate your patience as we worked through a rocky rollout with version 9.12

- Users with international cell phone numbers can now receive text messages with authorization codes for two-factor authentication

Payroll & Tax

Use labor assignments in Pay Item Default Values to calculate rates

Employee default labor assignments can be used to determine rates for union deductions and employer expenses

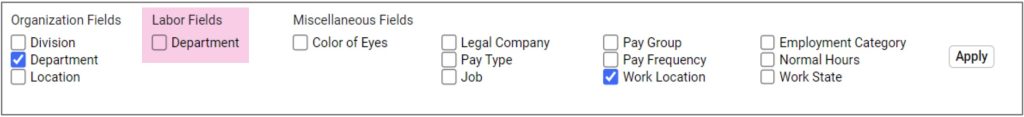

Pay Item Default Values are a powerful way to define rules that calculate union dues and prevailing wage fringe benefits based on the employee’s employment category, job, pay, work location, and organization fields. These union and fringe rates are often tied to the employee’s work classification, which is a labor field for clients who run certified payroll reports. You can now include labor fields when defining rules for Pay Item Default Values to better support clients with unions and certified payroll reporting requirements.

Tax changes in New Jersey and Scranton, PA are retroactive to January 1, 2023

HSAs are no longer exempt from New Jersey state income tax

Employee and employer contributions to Health Savings Accounts (HSAs) in a Section 125 plan are included in New Jersey income for state tax withholding effective January 1, 2023. For payrolls processed after the version 9.13 update on July 13, HSA pretax deductions and HSA employer contribution memos will be taxed for New Jersey state income tax. However, the system will not automatically recalculate payrolls that were processed earlier in the year. If you need to adjust New Jersey taxable wages in prior payrolls to include HSA contributions, please contact your Payroll Specialist for assistance with prior quarter adjustments.

Scranton, PA City Employer Payroll Expense Tax will recalculate YTD amounts

For employers who are in Scranton, PA, the City Employer Payroll Expense Tax will automatically recalculate in the first payroll posted after the 9.13 update on July 13th. The system will review taxable wages for the full year and adjust tax liabilities to ensure the 0.2787% tax rate was applied for all employees.

Washington CARES Fund exemption

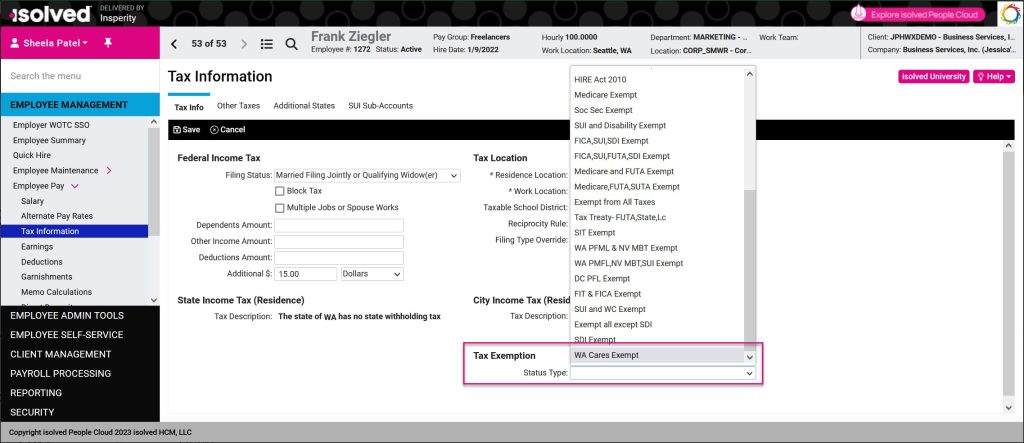

A new code has been added to exempt employees from the Washington CARES Fund

For employees who work in Washington but are exempt from making Washington CARES Fund contributions, use the new WA Cares Exempt Tax Exemption code on their employee Tax Information screen.

Benefit Services

COBRA Client Portal updates for benefit administrators

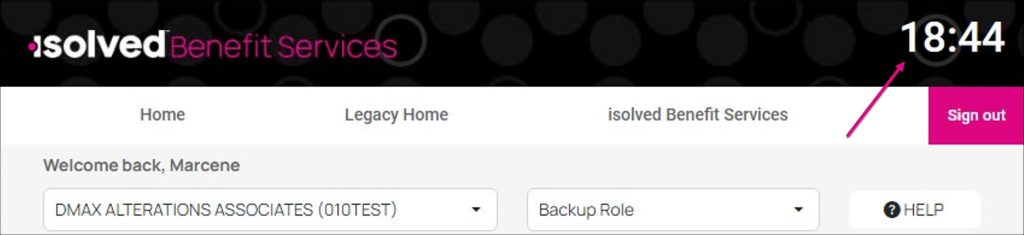

To safeguard protected health information, users who are inactive for 20 minutes will be automatically logged out

When you log into the COBRA Client Portal after the 9.13 release, a timer in the top right will count down for 20 minutes if you are not actively using the site.

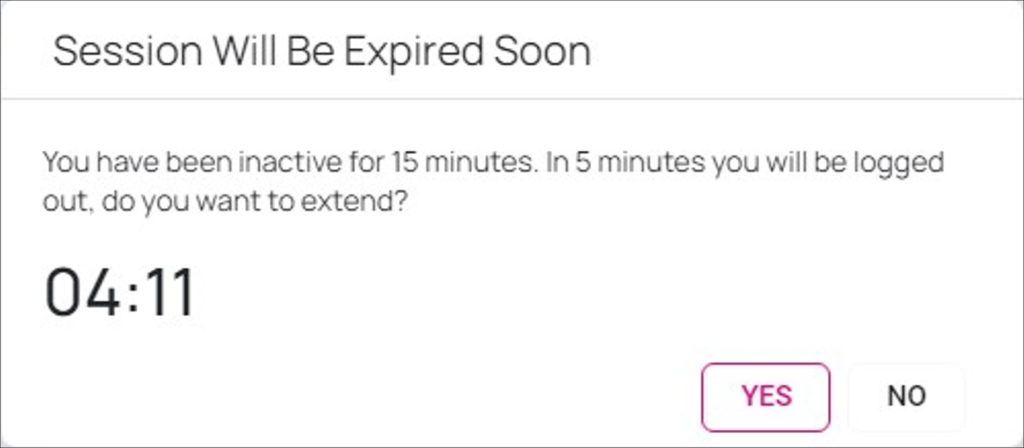

Once the counter reaches 5 minutes, an additional warning will appear allowing you to extend the session if you still need to use the COBRA portal.

If you click Yes, you can continue working. If you click No or do not choose an option, the session will end when the counter reaches zero. A message will appear letting you know that you have been logged out.

The Download Center has been enhanced to include copies of COBRA carrier feeds

Benefit administrators can see copies of the reports sent to their benefit insurance carriers again in the Download Center section of the Data Center in the COBRA Client Portal. Enter a date range and select Copy of Carrier Reports to download and review the information that was sent.

Access chat without logging in

To save time, you can now chat with the isolved Benefit Services COBRA team without having to log into the COBRA Client Portal. Simply click the COBRA Link option on the Client Management menu in isolved People Cloud to launch the login page and open chat at the bottom of the screen.

Self-Service

Stay in compliance with Voluntary Disability Self-Identification requirements

Disability self-identification in Onboarding and Self-Service uses updated OFCCP verbiage

The Office of Federal Contract Compliance Programs (OFCCP) requires contractors to implement the new Voluntary Self-Identification of Disability Form by July 25, 2023. The online version available in the Adaptive Employee Experience (AEX) and ESS Classic View meets the updated form requirements.

A copy of the revised verbiage is available from the Voluntary Self-Identification of Disability Form page on the OFCCP site.

Employee tax withholding form updates

Compliance updates are applied to federal, state, and local forms

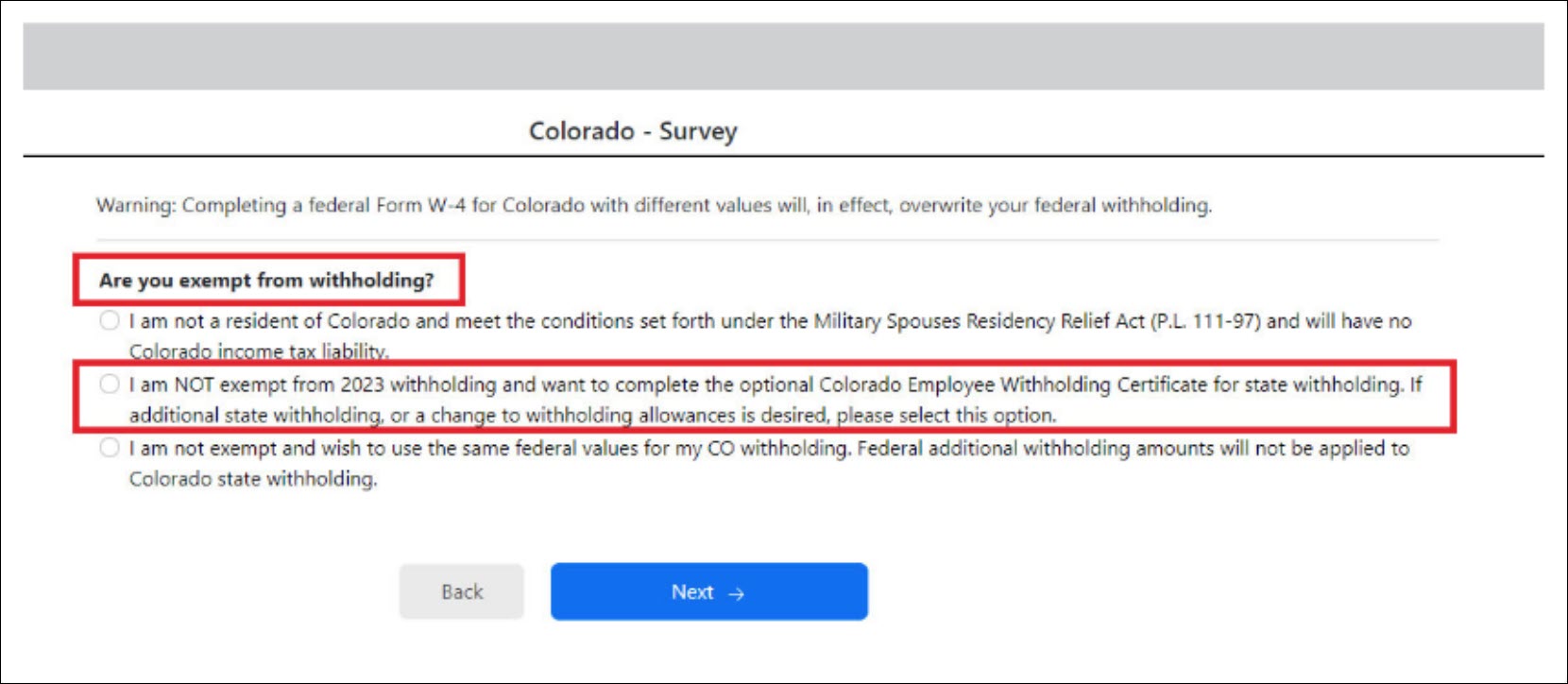

Employees who use the Tax Wizard to complete their tax withholding forms in the Adaptive Employee Experience (AEX) and ESS Classic View will see some changes after the version 9.13 release.

- Federal Form W-4, Employee’s Withholding Certificate

In Step 4c, the verbiage has been updated to say Enter any additional tax you want withheld each pay period. - Colorado Form CO-103, Employee Withholding Certificate

Language has been added to clarify that if you update Colorado withholding elections and do not have a Federal W-4 on file, the Colorado elections will also be applied as your Federal tax withholding elections.

The message has also been updated to clarify why an employee would choose to complete the Colorado withholding exemption form.

- Indiana Form IN-101, Employee’s Withholding Exemption and County Status Certificate

When entering additional exemptions on line 6, employees will only be able to enter integer values between 0 and 100. In certain scenarios, they had been able to enter additional digits that would result in errors. - Iowa Form IA W-4, Employee Withholding Allowance Certificate

An error has been corrected that prevented the state EIN from printing on line 1 of the new hire reporting section on the completed PDF version of the form. - Puerto Rico Form 499 R-4 and R-41

Employees were previously not marked exempt when they should have been. They will now be marked exempt from Puerto Rico tax withholding when they select:- I choose the provisions of the Military Spouses Residency Relief Act

- My income is less than or equal to $40,000 per year AND I am between the ages of 16 and 26, AND I choose that my employer consider the exemption on the first $40,000 from wages

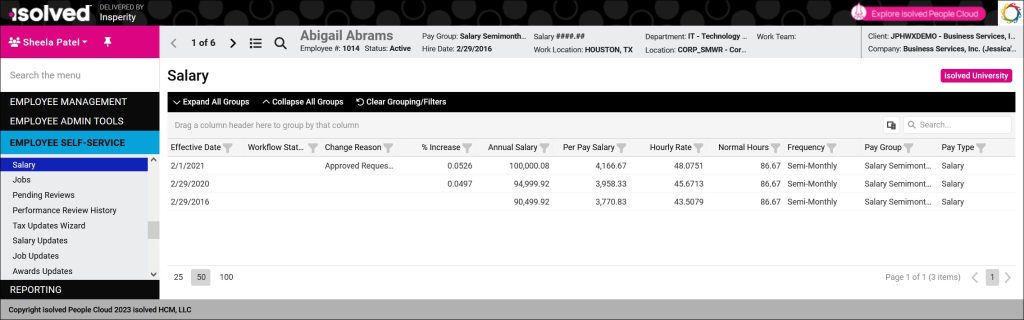

ESS Salary screen redesign

Supervisors and managers who view salaries through ESS Classic View will see a refreshed design

The Salary screen on the Employee Self-Service menu in ESS Classic view and isolved People Cloud has been updated to use the grid view with a column chooser, filters, and a Search option. This makes it easier to see salary changes over time.

Usability

More employee screens get the modern look and grid style

Navigate faster with the intuitive interface

As a continuation of the isolved screen design refresh, more screens have been updated with the modern look and new grid style. The overall functionality remains the same but they’re easier to navigate. The new screen designs include:

- Columns you can drag to reorganize and click to sort

- Filters on each column so you can group records or limit your view to find just the information you need

- A Search field to easily find specific records

- An XLSX button to quickly export your current view to Microsoft Excel

- Employee grid views include a Field Chooser to add additional columns of information to review your employee populations at a glance

- Employee grid views include Actions buttons or menus on each record that let you add, edit, or delete without having to scroll

Employee Management screen updates

The Employee Contacts screen has been updated to a new modern look. Navigate to Employee Management > Human Resources > Employee Contacts to check out the innovative design. You can now sort, filter, and group the information displayed on the screen. The Excel option has been removed.

Client Management screen updates

For client administrators who manage performance and company information, the following screens have been updated with the grid layout:

- Client Management > Client Maintenance > Notes

- Client Management > HR Management > Performance > Performance Review Ratings

Reporting screen updates

The Year End Report Archive in the Reporting section has been refreshed. Now you can sort, filter, and search your annual tax reports.

For more information about the changes in the version 9.13 release, contact your Payroll Specialist.