Friday, July 28th, 2023

Highlights

isolved version 9.14 includes an enhancement to AEX that allows employees to preview their check, information on the revised Form I-9 coming soon, tax updates for Illinois and Nevada, and an updated NY DBL/PFL Audit report.

Adaptive Employee Experience

- People Cloud is now Talent Management and Benefits Services is moving

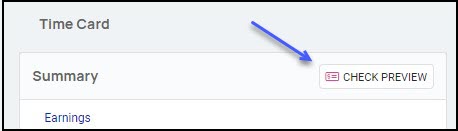

- Preview your check from your time card in AEX

Human Resources and Onboarding

- Revised I-9 – coming soon

Payroll & Tax

- Illinois reduces personal exemption amount retroactive to January 1, 2023

- Nevada increases base rates for the Modified Business Tax, effective July 1, 2023

Reporting

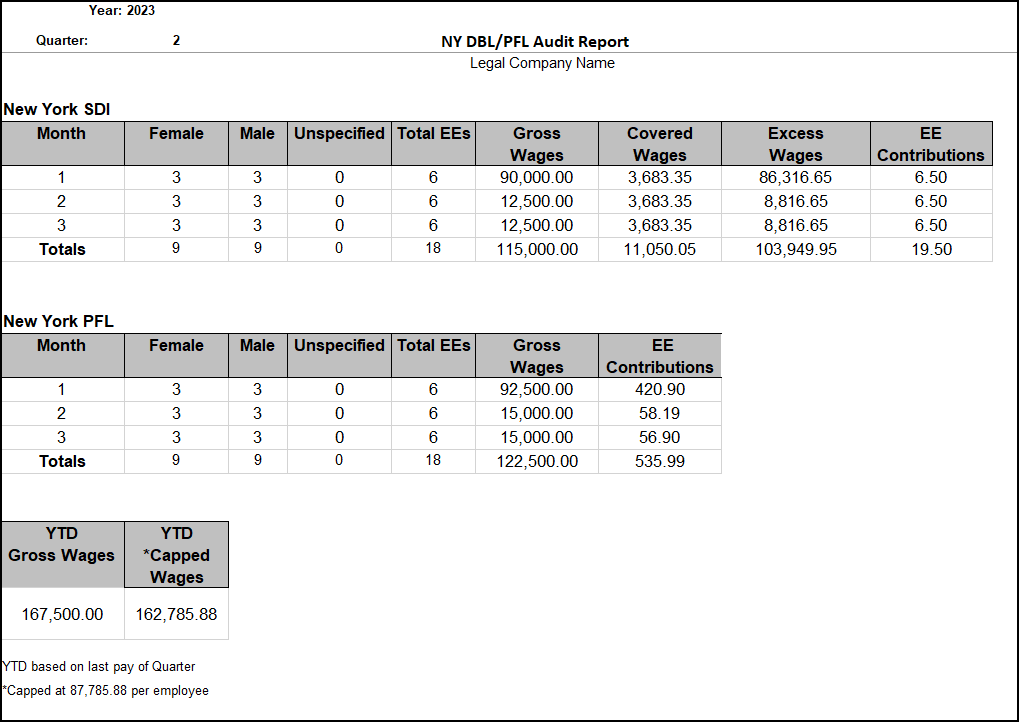

- The NY DBL/PFL Audit Report has been enhanced to include additional information

Usability

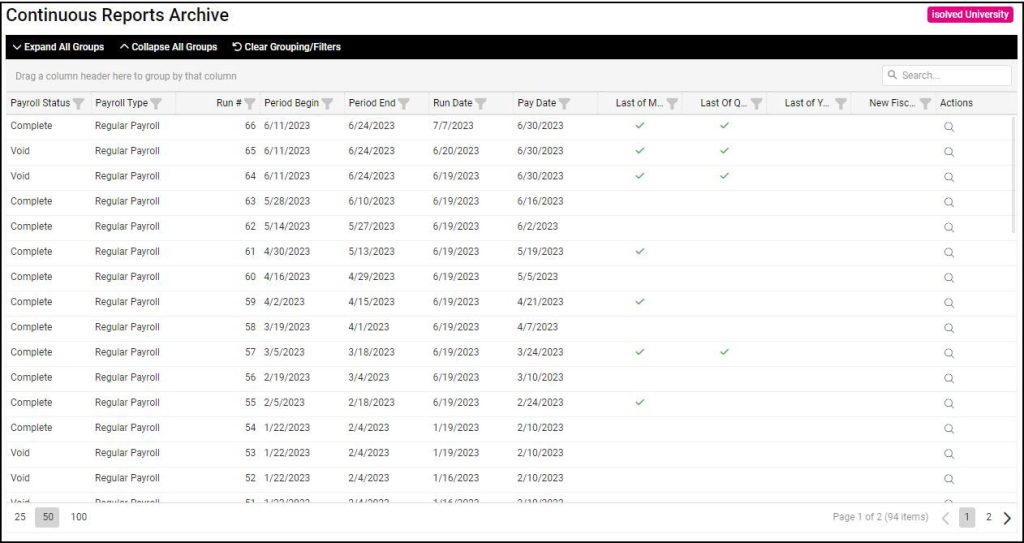

- The Continuous Reports Archive gets a fresh, new look

Adaptive Employee Experience

Enhancements to AEX make it easy for employees to find the information they need

Employees can now preview their check in AEX

Preview your check in the Adaptive Employee Experience by clicking on the Check Preview button in the Summary portion of your Time Card. If this feature is already turned on for your employees in Employee Self-Service Classic View, this feature is already available to your employees in AEX. If you don’t currently have this option activated and would like to turn it on for your employees, please reach out to Time Support at watime@insperity.com for assistance.

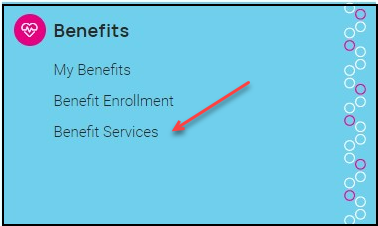

People Cloud is now Talent Management and Benefits Services moves under Benefits

What does People Cloud really mean anyway? People Cloud gets a new name, Talent Management! The People Cloud tile and menu options have been renamed to better represent the functionality the provide. While we are at it, we moved Benefit Services from Talent Management to under Benefits where it belongs.

Human Resources and Onboarding

U.S. Citizenship and Immigration Services announce a revised I-9 version

Updated I-9 available August 1, 2023

The U.S. Citizenship and Immigration Services announced they will publish a revised Form I-9 version on August 1, 2023. Employers may continue to use the current Form I-9 through October 31, 2023. Stay tuned for updates after the revised version is made available.

Payroll & Tax

IL reduced the 2023 individual income tax personal exemption retroactive to January 1, 2023

Alternate Calculation option available to catch up employee withholding

Illinois reduced the 2023 individual income tax personal exemption allowance to $2,425 for 2023. For employees that were on payroll from January to June, the amount of the income tax withheld for the remainder of the 2023 tax year may need to be adjusted. For some employees, the recalculated amount will result in no net change; however, for some it will result in a larger amount of tax withheld from each pay period remaining in 2023. Illinois provided another reduced allowance amount that will serve as a means to catch up an employee’s withholding. The amount for those employees is $2,225. By default, the exemption amount will be $2,225 and no action is required. However, there is a “$2425 Allowance” option available on the Employee Tax Information screen in the Alternate Calculation dropdown. When this option is selected, the allowance will calculate on $2,425. The default primary exemption amount of $2,225 will be supported for the remainder of 2023.

Employees starting or earning wages for the first time on or after June 7, 2023 are to use the $2,425 standard personal exemption allowance amount in withholding calculations.

Nevada updates Modified Business Tax base rates

Effective July 1, 2023 the base rate of the Modified Business Tax for General Businesses increases from 1.378% to 1.17%. There are no changes to the threshold of the sum of all taxable wages after deductions, currently at $50,000, or the Commerce Tax credit.

Reporting

Enhancements to the NY DBL/PFL Audit Report

Improved layout and the information you need

The NY DBL/PFL Audit Report has been enhanced to make it easier for you to understand and find the information you need. When you view the updated report, you will see noticeable improvements that include separate sections for New York SDI and New York PFL, as well as new fields that show YTD Gross and Capped Wages.

Usability

Another screen gets the modern look and grid style

Navigate faster with the intuitive interface

As a continuation of the isolved screen design updates, the Continuous Report Archive in the Reporting section has been refreshed. Now you can sort, filter, and search your payroll reports. Click on the magnifying glass to see a list of reports to view or print.

For more information about the changes in the version 9.14 release, contact your Payroll Specialist.