Friday, August 25th, 2023

Highlights

isolved version 9.16 includes screen updates, a new garnishment option for California employers to stay compliant, and a new Glossary in the University.

Payroll & Benefits

- New California garnishment option to support lower garnishment limits in California SB-1477

- The HSA catch-up age has been corrected so employees aged 50 – 54 are no longer considered eligible for the higher catch-up IRS limits

HR & Employee Management

- You can now easily export Employment Status History with the update to the modern grid view

Training & Development

- A glossary has been added to the University to quickly understand key topics and concepts

- Quickly access the employee Certifications page by clicking their name on the Certifications dashboard

Time & Labor Management

- The Percent Distribution screen has been updated with the new design

- Payroll processors should no longer receive verification errors when committing time cards that have all been fully verified

Payroll & Benefits

New garnishment option to support California legislation

Lower creditor garnishment limits take effect on September 1, 2023

Legislation included in California Senate Bill 1477 reduces the amount that can be garnished from employees. Effective September 1, 2023, garnishments are limited to 20% of disposable income or 40% of the amount by which earnings exceed 40 times the California state or local minimum wage, whichever is less. Previously, the limit was the lesser of 25% of disposable income or 50% of the amount by which earnings exceed 40 times the California state or local minimum wage. Existing garnishments will not change with this release. The new California garnishment option has been added to support garnishments that are issued after the changes take effect.

Correction to HSA catch-up age

Employees aged 50 – 54 were erroneously increased to the HSA catch-up limit, allowing potential overcontribution of $1000

A bug was introduced with the version 9.14 release on July 28, 2023 that incorrectly changed the catch-up age for HSA plans from 55 to 50. This issue resulted in employees aged 50 – 54 being treated as eligible for the higher HSA annual limits of $4850 for self-only coverage and $8750 for family coverage. This issue may have impacted employees in two ways:

- If employees aged 50 – 54 were enrolling in an HSA plan in August, they would have been allowed to select an annual contribution limit of $4850 for self-only coverage or $8750 for family coverage instead of the $3850 self-only or $7750 for family limits that should have been applied.

- If you are using Benefit Administration for your HSA plans and employees previously elected their target annual contributions, then the system would still have limited them to their annual target, so they are not likely to be affected. But if you entered HSA deduction overrides or are not using Benefit Administration for HSA plans, then it is possible for an employee aged 50 to 54 to have contributed above their IRS limit for pretax HSA deductions.

To determine if you have any impacted employees, run the Payroll Register Export by Date Range or Periodic Payroll Register by Date Range for the full calendar year. Review the employee YTD HSA deduction totals to find any employees who contributed above the $3850 or $7750 limits. If you have an employer HSA contribution, you will need to sum the employee and employer YTD contributions, since they count together toward the limit. You can also reference the Benefit Plan Detail reports to determine whether employees elected individual or family HSA contributions. For any employees who are above the standard limits, confirm they are aged 55+ in the 2023 plan year and are eligible for the additional $1000 catch-up contributions.

If you find any employees whose annual pretax HSA deduction is too high, you can process a negative deduction in their next payroll to pay them back for the amount above the limit.

Contact your Payroll Specialist for assistance determining if you are impacted or making corrections.

If HSA contributions over the IRS limit have already been funded into the health savings account of an impacted employee and you use isolved Benefit Services for HSA administration, your Benefits Support team will assist with issuing refunds from the account so you stay in compliance.

The incorrect HSA catch-up age has been corrected in this release, so annual limits will be applied correctly moving forward. Only employees aged 55 and older will be eligible for the additional $1000 in HSA contributions.

HR & Employee Management

Employee Management screens get the modern look and grid style

Navigate faster and easily export data with the intuitive interface

As a continuation of the isolved screen design refresh, some Employee Management screens have been updated with the modern look and new grid style. The overall functionality remains the same but they’re easier to navigate. The new screen designs include:

- Columns you can drag to reorganize and click to sort

- Filters on each column so you can group records or limit your view to find just the information you need

- A Search field to easily find specific records

- An XLSX button to quickly export your current view to Microsoft Excel

- Employee grid views include a Field Chooser to add additional columns of information to review your employee populations at a glance

- Employee grid views include Actions buttons or menus on each record that let you add, edit, or delete without having to scroll

Training & Development

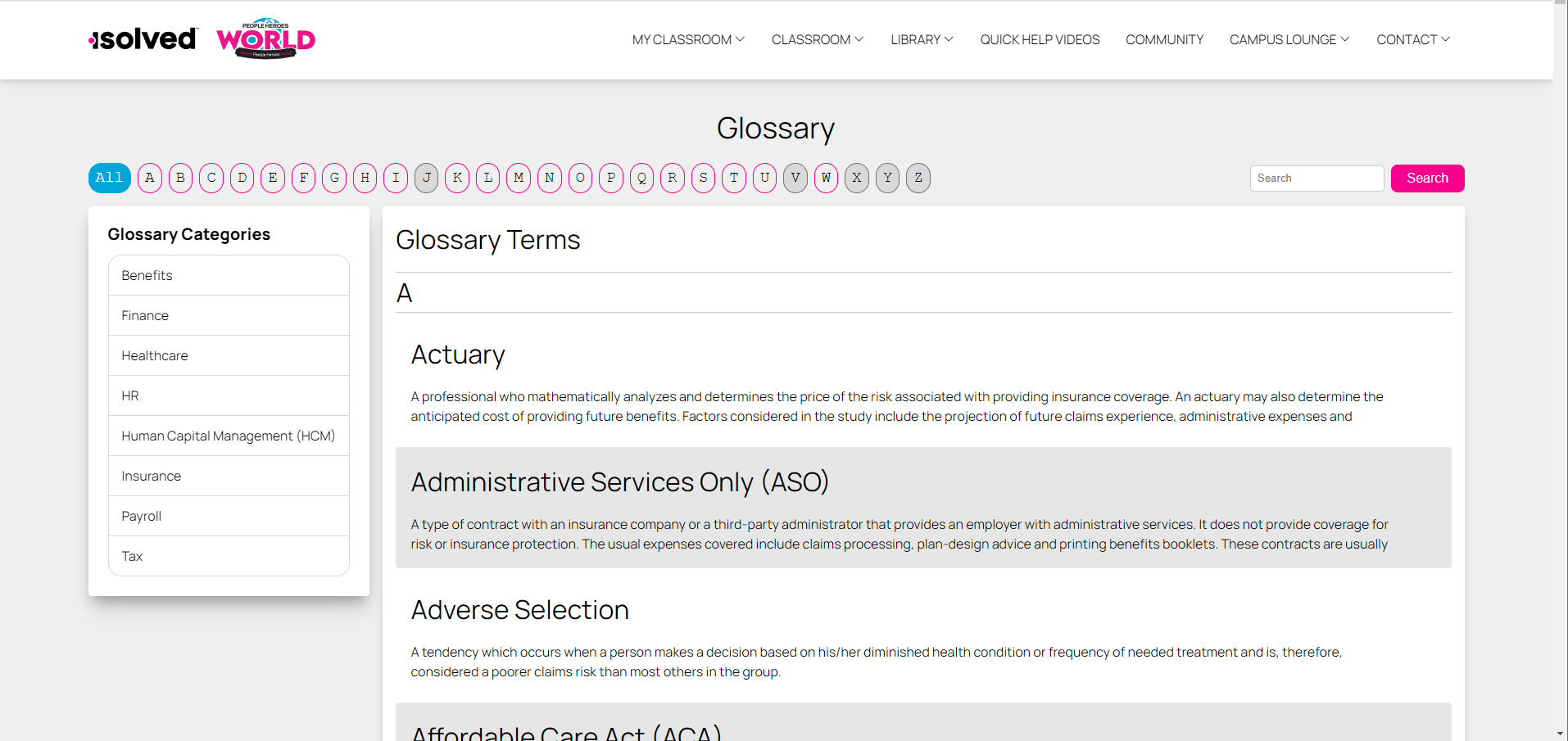

New Glossary in isolved University

Quickly learn key HCM terms and concepts

A new Glossary feature is available from the Library menu in isolved University. Learn HCM terminology with concise definitions and other related keywords to become an expert in all aspects of benefits, HCM, payroll and tax.

Analytics dashboards provide key information at a glance

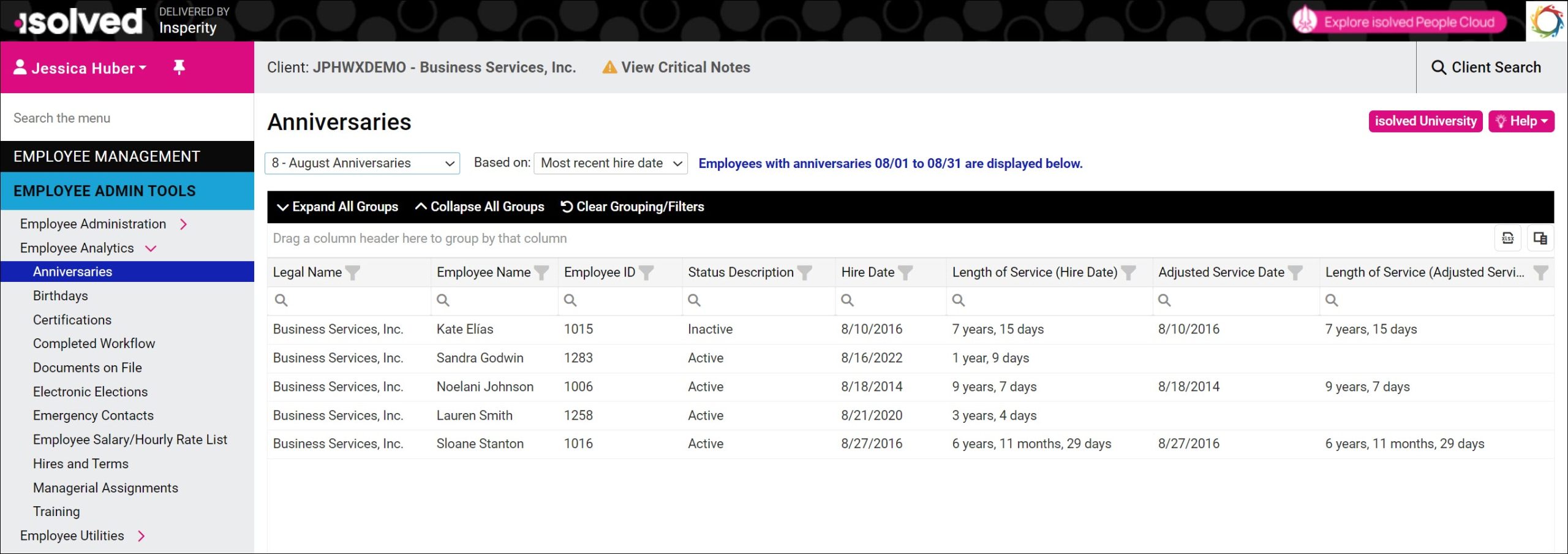

Sort, view and filter key employee information from the Employee Analytics section on the Employee Admin Tools menu

Did you know that you can quickly evaluate employee data using analytics dashboards?

- Find upcoming employee anniversaries, view anniversaries by month, or review years of service from the Anniversaries dashboard

- Find upcoming birthdays or view birthdays by month so you know who to celebrate using the Birthdays dashboard

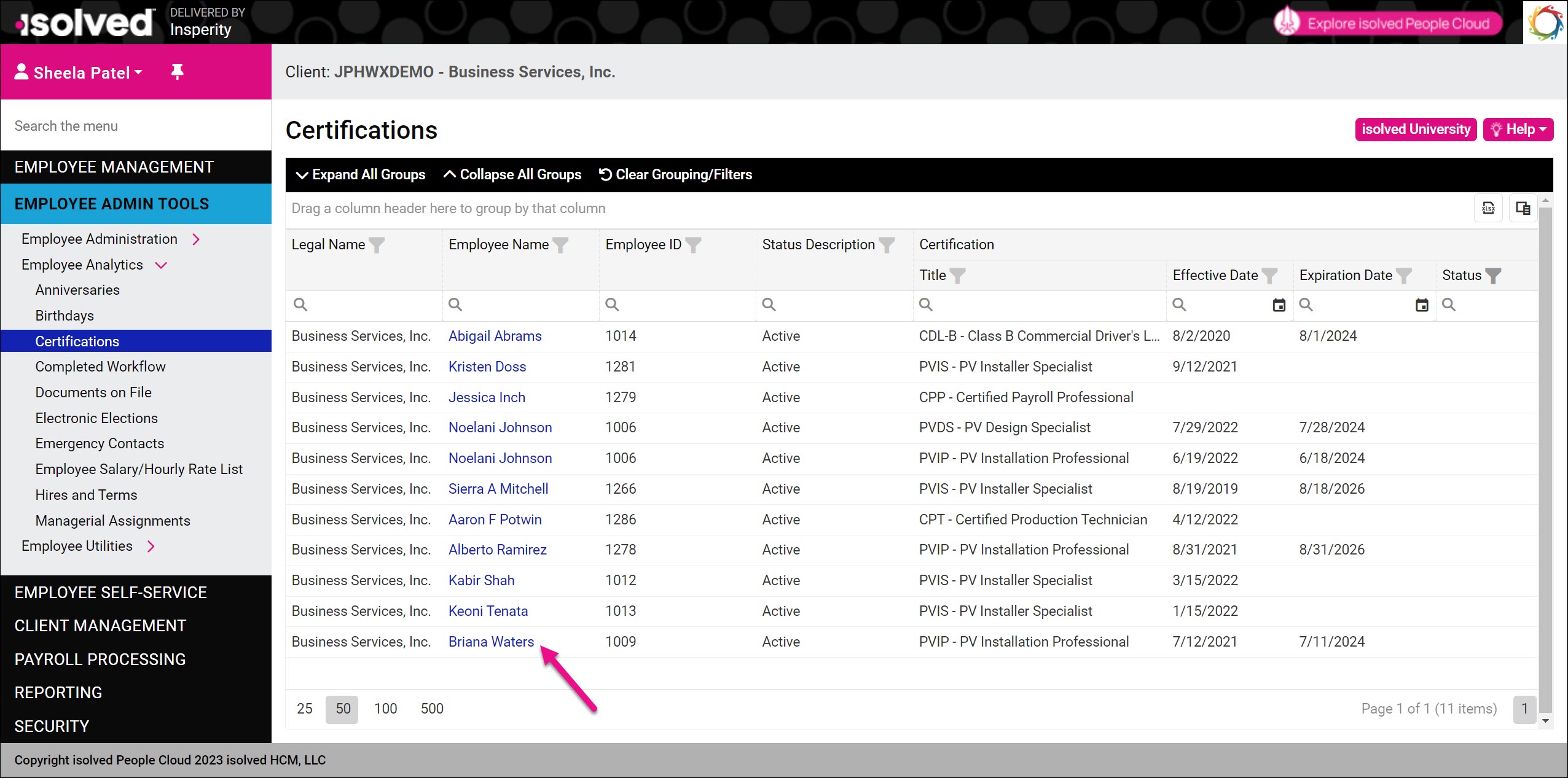

- Quickly find employees whose certifications are due for renewal from the Certifications dashboard. You can now navigate easily to drill down and review a particular employee’s certifications by clicking on their name.

- Completed Workflow lets you see all the employee updates that have been approved or rejected in the date range you enter. Sort and filter by transaction type and see who issued the final approval or rejection.

- Documents on File lets you review employee documents by category and subcategory. You can also find employees who are missing specific document types so you can track them down and stay compliant.

- Electronic Elections comes in handy as you prepare for year-end so you can see who has consented to receive their year-end forms online in the Adaptive Employee Experience (AEE) or ESS Classic View

- Emergency Contacts helps you easily determine which employees still need to provide emergency contact information, or find the number you need to call quickly in an emergency.

- The Employee Salary/Hourly Rate List lets you review compensation to ensure you stay compliant with minimum wage changes. See How do I find employees who are being paid below minimum wage? for more information.

- When you need to easily find employees who were hired or terminated in a specific timeframe, use the Hires and Terms dashboard.

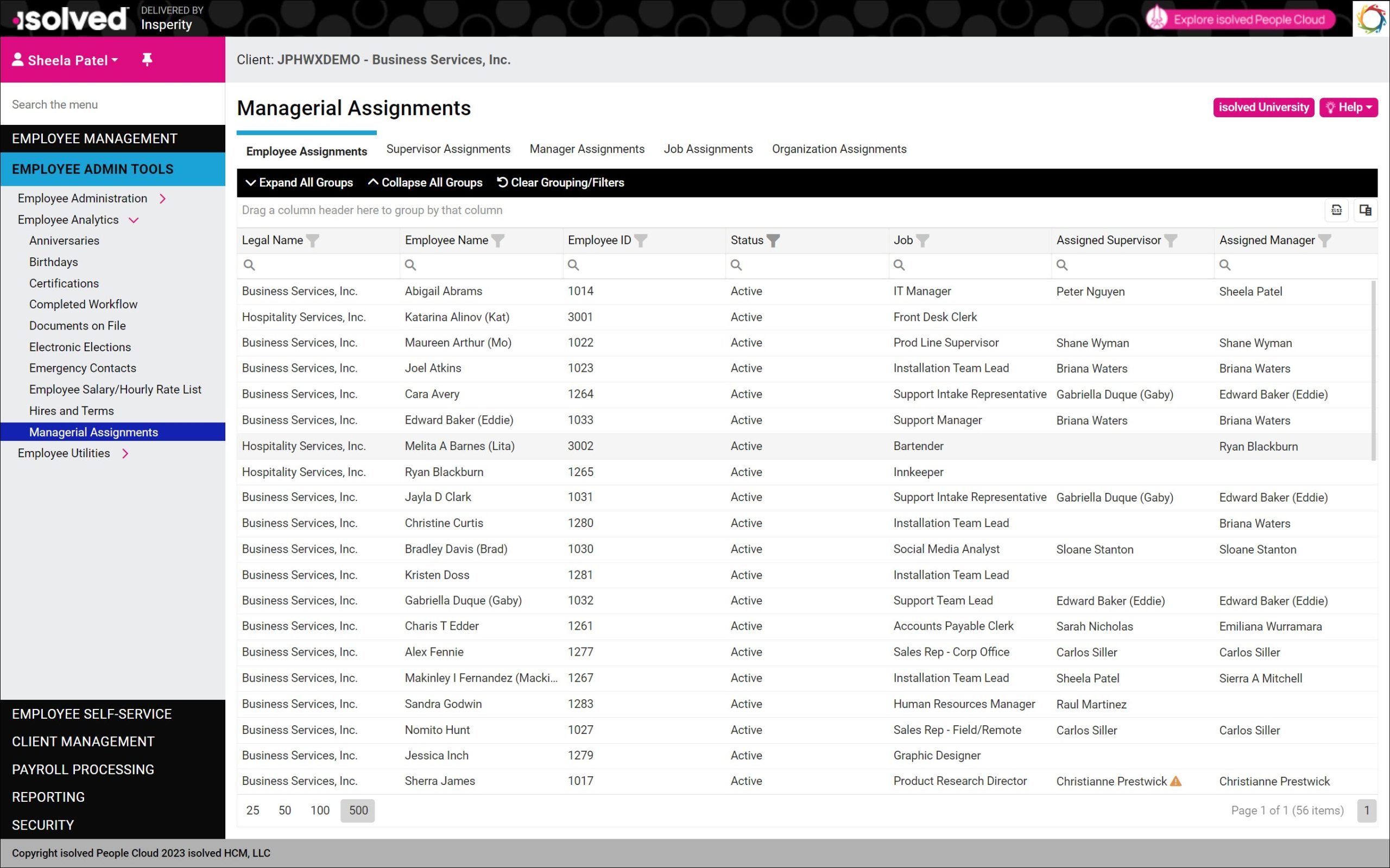

- Supervisors and managers perform critical roles like reviewing applicants, verifying time cards, approving workflows, giving performance reviews, and approving benefit elections. Make sure employees are assigned to the correct supervisors and managers using the Managerial Assignments dashboard.

- If you choose to track completed training courses in isolved People Cloud instead of the powerful Training & Development eLearning platform included in Workforce Acceleration, you can review completed courses from the Training dashboard.

Time & Labor Management

Review and export automatic labor allocations with the updated screen

Percent Distribution has the modernized record view

The Percent Distribution screen has been updated to a new modern look. Navigate to Employee Management > Employee Maintenance > Percent Distribution to check out the updated design. You can now search by earning type.

Commit timecards without Verification errors

The bug has been fixed that caused Verification warnings and errors for verified time cards

In certain scenarios, payroll processors could receive a warning or error message saying time cards had not been verified for employees whose time cards had actually been approved already. That issue has been fixed, so if you see verification messages in the Commit Time Cards step after the 9.16 release, it is an accurate reflection of their status.

For more information about the changes in the version 9.16 release, contact your Payroll Specialist.