Friday, November 3, 2023

Highlights

isolved version 9.21 includes the release of the isolved People Cloud Mobile App, federal and state tax form updates, time card and Manage Shift Import enhancement, and Employee Change Log and Client Compensation Plan screen updates.

Identity & Access Management

- Identity Phase 2 Security Enhancements – coming December 1st *new date*

Adaptive Employee Experience (AEX)

- Introducing the isolved People Cloud Mobile App!

Payroll & Tax

- New York Metropolitan Commuter Transportation Mobility Tax (MCTMT) report calculations have been updated

- Federal Form W-4 calculated field rounding update

- Several state tax form changes – Colorado, Connecticut, Michigan, North Carolina, Wisconsin

Time & Labor Management

- Manage Shift Imports – You can now create imports for the Manage Shifts screen!

- Time Card Report enhancement to include custom alert on report

Employee Management & HR

- You will now be able to select multiple filters on the Employee Change Log screen

- The Client Management Compensation Plans screen is redesigned with the modern grid view

Identity & Access Management

IdentityServer Phase 2 has a new release date!

The isolved security enhancements associated with IdentityServer Phase 2 will now be released with isolved v9.23 on Friday, December 1st.

These Phase 2 enhancements provide additional security measures to help prevent fraudsters from accessing your critical employee information, including multi-factor authentication and a reduced inactivity timeout. Cybercriminals have become more sophisticated, so your Insperity Workforce Acceleration™ technology is changing to keep pace.

Watch this quick video overview showing how logging in will change after December 1st, 2023. Changes are also coming to the timing of automatic logouts in the upcoming release for added security. This article answers common questions and includes additional resources.

Adaptive Employee Experience (AEX)

isolved People Cloud Mobile App

Now available in the Android and apple App Stores!!

All the power of the Adaptive Employee Experience (AEX) is available now as a mobile app for managers, supervisors, and employees on iOS and Android devices.

The new isolved People Cloud app makes it easy for users who like the simplicity of downloading from the Google Play and App store. It’s a convenient, flexible, and secure way to effortlessly enter time, enroll in benefits, and view pay stubs on their preferred device.

Here is a link to the full article – Announcing the isolved People Cloud mobile app

Payroll & Tax

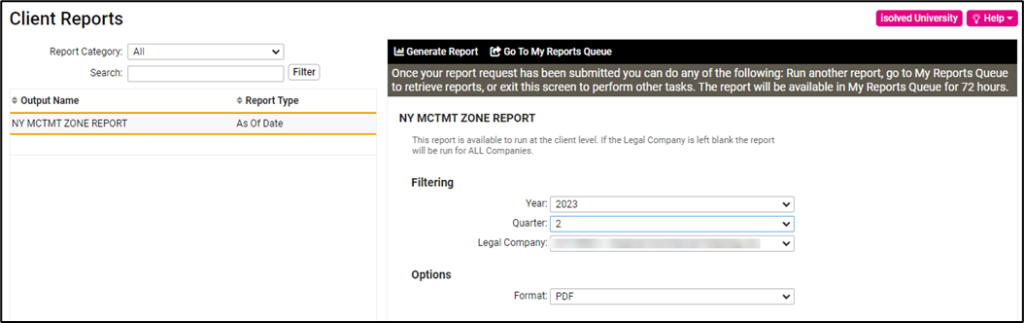

New York Metropolitan Commuter Transportation Mobility Tax Zone Report

Report Enhancement

An update has been made to the reports tax calculations. If you have been manually calculating the tax rate as a workaround, you will no longer need to do this after 11/3.

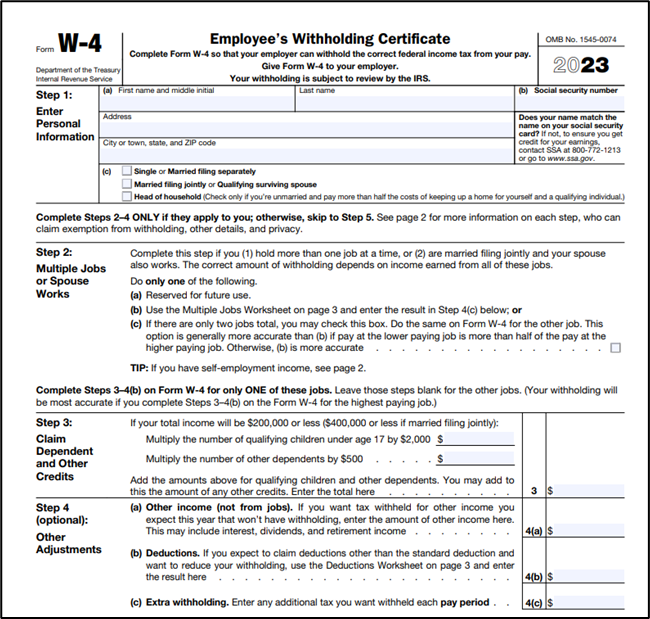

Federal Form W-4 Changes

Form W-4 calculated field rounding update

The following calculated field will now round to the nearest whole dollar within Form W-4 as described in the question test itself:

- 4 – Divide the annual amount on line 1 or 2c by the number of pay periods on line 3 (you may round this to the closest whole dollar amount). Enter this amount here and on line 4c of Form W-4 for the highest paying job.

State Tax Form Changes

Colorado DR 1059 Updated

Form Title: Affidavit of Exemption for the Nonresident Spouse of a US Servicemember

SPF Form ID: CO102

Form version: 2023.10.0

The following changes have been made to the Form DR 1059:

- Revision date was updated from 09/26/2019 to 07/20/2023

- Paragraph alignment in the form instructions has been updated to left justified

- Servicemember definition has been updated to include “Space Force” members

Connecticut Form CT-W4NA validation message updated

In the new user interface, we’ve updated the validation message on Line 3 to indicate that the number entered on Line 1 must be greater than or equal to the sum of Line 2 and Line 3. Previously, the message indicated that the value in Line 3 must be less than or equal to Line1.

Michigan Form MI-W4 Updated

Form Title: Employee’s Michigan Withholding Exemption Certification

SPF Form ID: MI101

Form version: 2020.12.0

If an employee does not enter any additional state tax withholding for the MI-W4, then the Additional State Withholding tax parameter will now return “0” (in order to be consistent with other state forms). Previously, an empty string “ “ was returned if no value was provided.

North Carolina Form NC-4 NRA nonresident survey question added

Form Title: Nonresident Alien Employee’s Withholding Allowance Certificate

SPF Form ID: NC103

Form version: 2022.12.0

The NC-4 NRA has instructions which state:

“Generally, a nonresident alien is not eligible for the standard deduction. Line 2 of this form requires the nonresident alien employee to enter an additional amount of income tax to be withheld for each pay period to account for the inclusion of the standard deduction in the wage bracket tables, percentage, and annualized methods of computing income tax withheld. The additional tax to withhold per pay period is identified in a chart on page 2 of the Form NC-4 NRA and represents the income tax on the standard deduction for the single filing status ($10,750) divided by the number of payroll periods during the year. For example, an employee paid monthly is required to enter $48 ($10,750 x 5.35% / 12z). The additional withholding properly addresses the tax impact of the ineligibility for the standard deduction for most nonresident alien employees. However, the additional withholding results in over withholding on nonresident alien employees who are either students or business apprentices from India. These individuals should report $0 on Line 2.”

We have added a question to the NC-4 NRA survey, asking the employee if they are a nonresident student or business apprentice from India. If the select Yes, the from will populate line 2 to $0.

Previously, it did not ask the employee of they were from India and required them to select their pay period, and then populate a value in line 2 based on that selection:

If an employee responds No, stating they are not a nonresident student or business apprentice from India, the form will continue to populate line 2 based on their pay period selection.

Wisconsin Form WT-4 Update

Form Title: Employee’s Wisconsin Withholding Exemption Certificate/New Hire Reporting

SPF Form ID: WI101

Form version: 2023.10.0

Effective July 1, 2023, the following changes have been made to Form WT-4:

- Revision date in the lower left-hand corner of the first page was updated from “(R. 7-22)” to “(R. 8-23)”

- Under Applicable Laws and Rules on the top of the second page, the enacted date was updated from “July 5, 2022” to “August 23, 2023”

Time & Labor Management

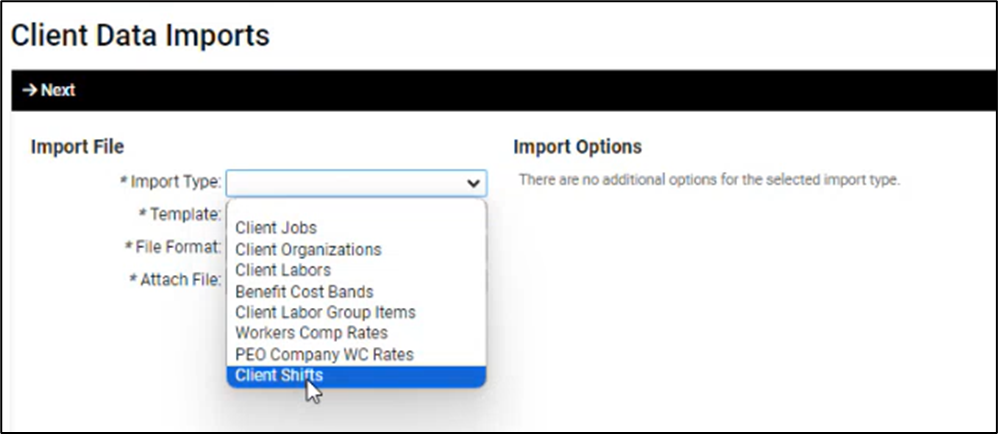

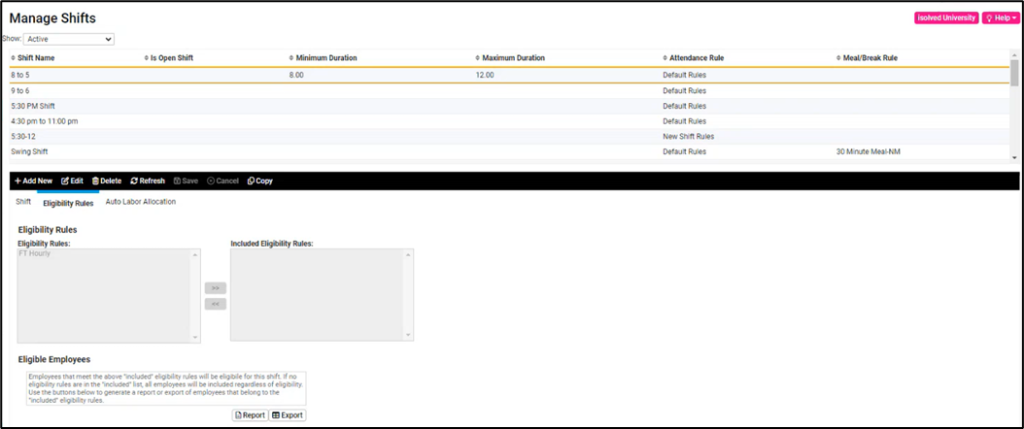

Manage Shift Imports

Import Enhancement

You can now create imports for the Manage Shifts screen. Users can overwrite existing shifts in the system if they import shifts with the same name. There is a validation that the import goes through before uploading, to give the user a chance to confirm the information before merging it with isolved.

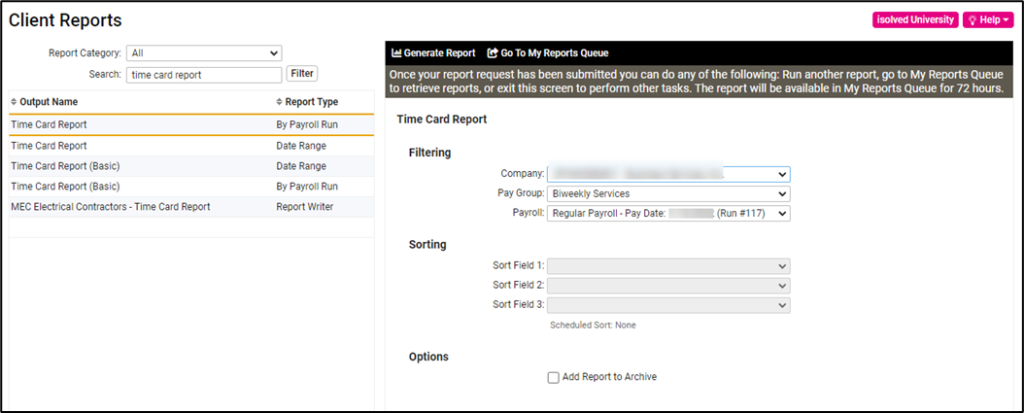

Time Card Report

Report Enhancement

For clients using Time Cards, when a custom alert is set up and gets triggered, it will now show on the Time Card Report.

Employee Management & HR

Screen Enhancements

The effort continues in this release to modernize the screens in isolved People Cloud. Over the next few months, additional screens will be refreshed using the new grid style that you’ve already seen on other screens. The overall functionality stays the same with some differences noted below.

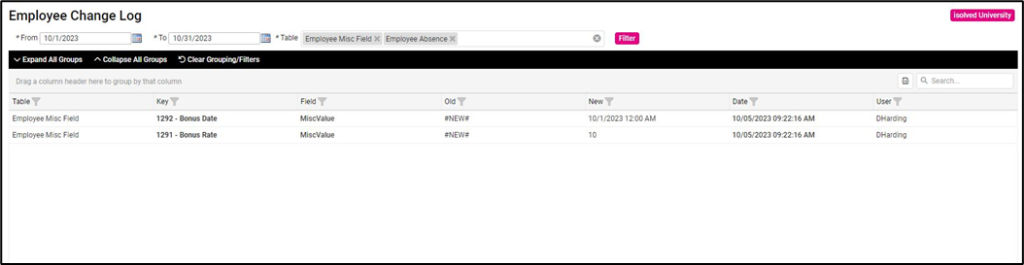

Table Employee Change Log Filter Enhancement

You can now select multiple tables when looking at the Employee Change Log under Employee Admin Tools > Employee Utilities > Employee Change Log. Previously, only one table could be selected at a time.

Updates to this screen include:

- A search bar was added

- Updated grid layout

- Added filtering for each column

- From date defaults to 30 days prior to today’s date

- To date defaults to today’s date

- Users can now select multiple tables

- Key description appears on in export file

Client Management

In this release, the Client Management > Tables > Compensation Plans screen has been updated:

- Updated grid layout

- Users can export data

- Added filtering for each column

For more information about the changes in isolved version 9.21, please contact your Payroll Specialist.