For clients who empowered employees and contractors to receive their year-end tax forms online, they were automatically prompted to make their consent choice during initial registration or when they logged in for the first time after the electronic delivery option was enabled. Their choice controls online access to their W-2, 1099-NEC, and ACA forms.

Employees who have consented to electronic delivery in ESS Classic View

Employees who have already agreed to electronic delivery can view the Terms and Conditions of their consent if they have access to Employee Documents in ESS Classic View.

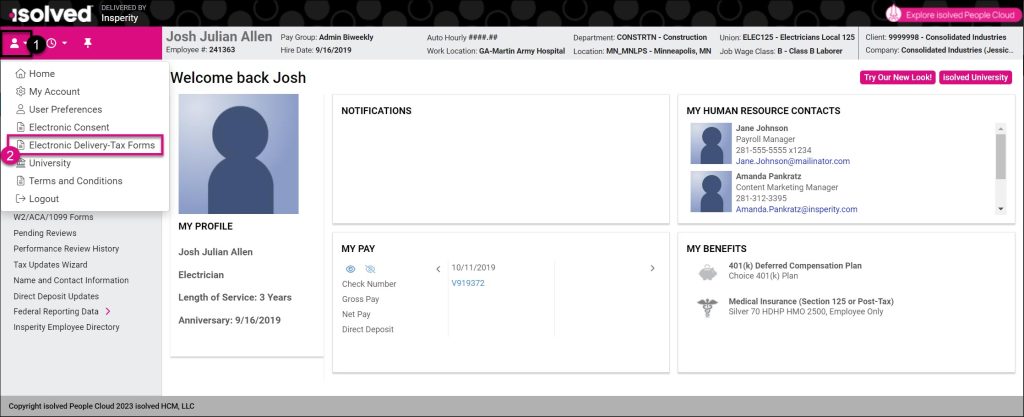

- Click the user menu icon

to access the user menu.

to access the user menu. - Select Electronic Delivery Tax Forms.

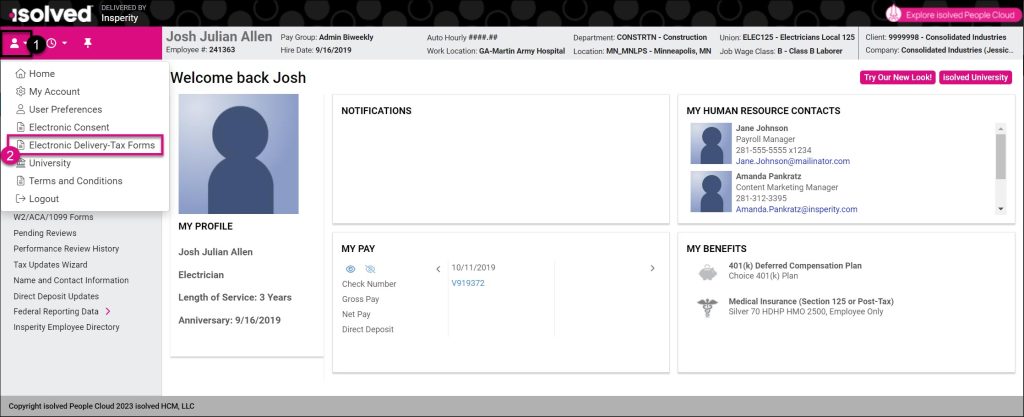

- If the employee has already given consent to electronic delivery, they will see a message indicating they already have agreed.

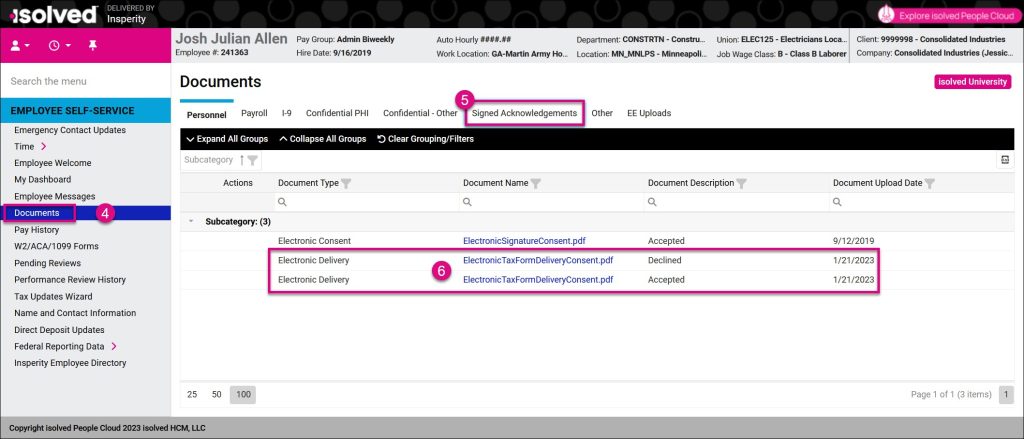

- They can read the Terms of Use and Consent to Electronic Delivery of Year-End Tax Forms in the Documents section. Click Documents from the menu.

- Click the Signed Acknowledgements tab to view the Terms of Use for each year-end tax form delivery election. If the employee made multiple elections over time, each consent choice will be listed.

- Click the Document Name link to open the Terms of Use.

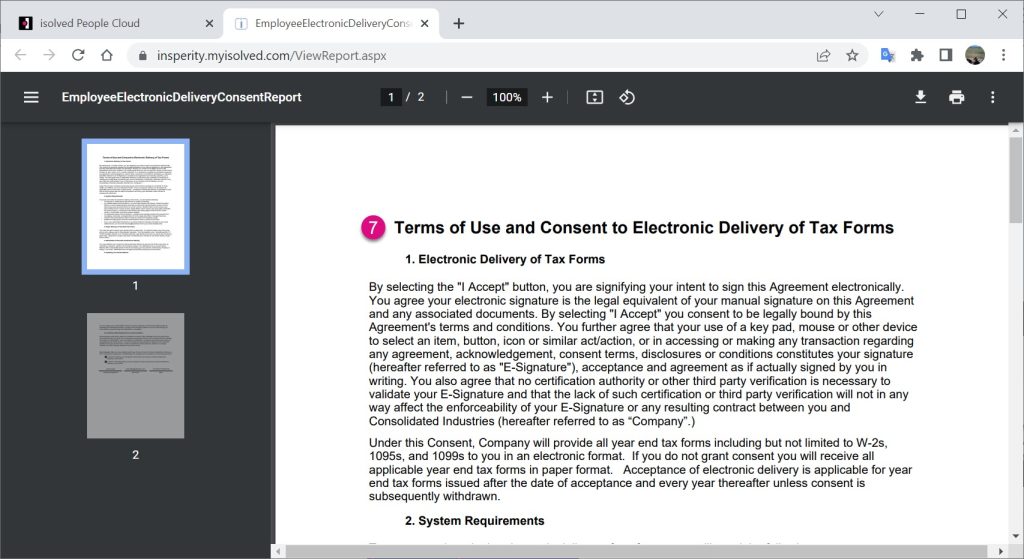

- The Terms of Use will open in the employee’s preferred PDF viewer.

Employees who have declined electronic delivery

For employees who previously declined electronic delivery, they can change their election in ESS Classic View.

- Click the user menu icon

to access the user menu.

to access the user menu. - Select Electronic Delivery Tax Forms.

- Read the Terms of Use and Consent to Electronic Delivery of Year-End Tax Forms and scroll to the bottom. Click I Accept.

Removing consent to electronic delivery

If employees previously consented to electronic delivery of year-end tax forms and want to remove that consent, they will need to contact their isolved People Cloud administrator for assistance. See How can I withdraw the consent for electronic delivery of year-end tax forms for an employee? for more information.

Employees who have consented to electronic delivery will no longer receive a printed copy of their year-end tax forms. They will be able to access forms electronically.