Friday, June 30th, 2023

Highlights

isolved version 9.12 includes information about the isolved account migration that occurs with this release, an enhancement to the Adaptive Employee Experience for Managers and Supervisors, and updates to isolved People Cloud and ESS Classic View as part of the modernization effort. Make sure you read to the end to get prepared for the end of COVID-related I-9 accommodations on July 31st, plus reminders about updates to the employee minimum wage in some locations and information about WA Cares premiums, both of which go into effect on July 1st.

Payroll

- WA Cares premiums begin July 1st for most workers in Washington state – Reminder

- Increased minimum wage rates go into effect July 1st for some areas of California, Illinois, Maryland, and Washington – Reminder

- Vertex state and local tax updates

Security

- IdentityServer account migration – now!

Adaptive Employee Experience

- Managers and supervisors now have access to employee documents in AEE

Usability

- More screens get a refreshed look to make it easier than ever to manage employees

Onboarding & HR

- Are your I-9 verification processes ready to return to pre-COVID standards? Temporary accommodations are expiring July 31, so learn how to stay compliant with WX. – Reminder

Payroll

WA Cares premiums, new minimum wage rates for some locations, and state and local tax updates

WA Cares premiums begin July 1st

The WA CARES FUND EE tax will automatically be added to companies with an active WA PFL tax set up. For employees who work in Washington, the employee contribution rate is 0.0058 of subject wages, with no cap on wages. For additional information about WA Cares please read this short article in the Help Center.

New minimum wage rates for some locations effective July 1st

When legislation is passed to change federal, state, and local minimum wage rates, isolved system rate tables are automatically updated to help you stay in compliance. But the system will not automatically change employee pay, since you are always in control of what your employees earn.

For step-by-step instructions about how to easily review your employee wage rates for compliance and how to add or change salary/pay rate information, please see the Reviewing pay information for minimum wage compliance article in the Help Center.

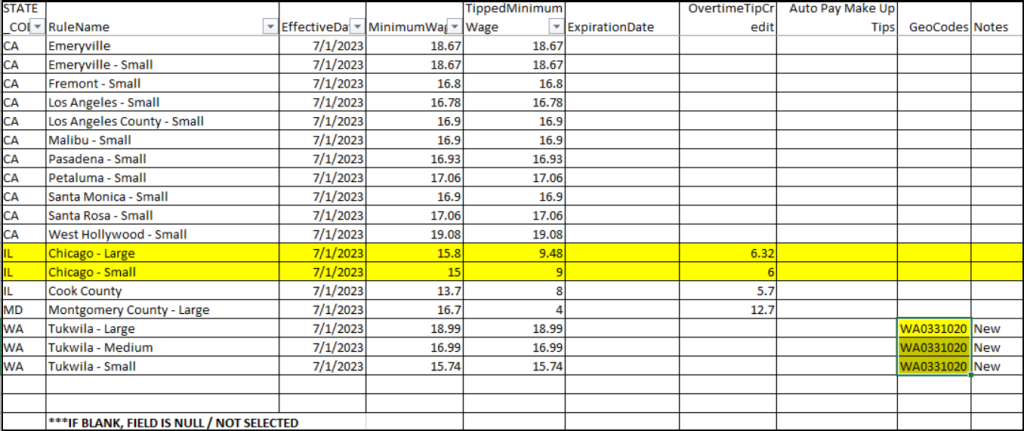

The following locations in California, Illinois, Maryland, and Washington have a new minimum wage rate going into effect on July 1st.

In order to support different minimum wage rates, a new geocode has been created for Tukwila, Washington. If you have work locations in Tukwila, please contact your Payroll Specialist to create a new system work location for you.

Vertex state and local tax changes

Arkansas tax changes

Arkansas made the following changes to withholding, effective 6/1/23:

- Decreased the supplemental withholding tax rate from 4.9% to 4.7%

- Decreased the midrange income lookup amount from $91,801 to $91,301

- Revised the withholding tables

Idaho tax changes

Idaho made the following tax changes, effective 1/1/23:

- Increased the withholding allowance from $3,417 to $3,534

- Decreased the supplemental tax rate from 6% to 5.8%

- Revised the withholding tables

New York tax changes

New York increased the maximum Metropolitan Commuter Transportation Mobility Tax rate from .34% to .6%, effective 7/1/23. The following counties are affected:

- Bronx 33-005-0000

- Kings 33-047-0000

- New York 33-061-0000

- Queens 33-081-0000

- Richmond 33-085-0000

North Dakota tax changes

North Dakota revised their withholding tables, effective 1/1/23.

Ohio tax changes

Ohio changed the following Local taxes:

- Bucyrus, Crawford County (36-033-0350)

- Increased the tax rate from 2% to 2.25%, effective 7-1-23

- Hiram, Portage County (36-133-5611)

- Decreased the credit limit from 2.25% to 1.25%, effective 1-1-23

- Wilmot, Stark County (36-151-5737)

- Decreased the tax rate from 1.5% to 1%, effective 1-1-23

- Decreased the credit limit from 1.5% to 1%, effective 1-1-23

- Yellow Springs, Greene County (36-057-2950)

- Decreased the credit percentage from 100% to 50%, effective 1-1-23

Washington tax changes

Washington added the Washington Cares Fund tax with an employee tax rate of .58% of earnings, effective 7/1/23.

Adaptive Employee Experience

New feature added to the Adaptive Employee Experience (AEE)

Managers and supervisor access to employee documents

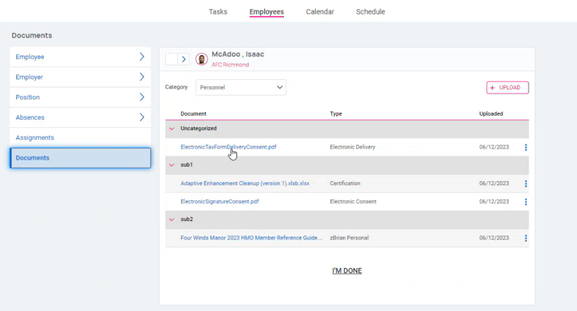

The Adaptive Employee Experience gets a new feature! Managers and supervisors can now add, edit or delete employee documents through AEE. Your company decides to allow either Full or Read Only access. Full access allows managers and supervisors to upload, edit and delete documents.

Navigate to Manage > Employee Documents. To add a new document, click on the Upload button and define the type of document you are importing and assign an access level. Click on the ellipses to edit or delete a document.

To take advantage of this feature, please contact your Payroll Specialist to have the new Adaptive Assignments role enabled for your company.

Security

isolved account migration – June 30th

Your isolved accounts have migrated to the IdentityServer

Effective Friday, June 30th, the new login experience is live for all users. The first time you log in to isolved on or after June 30th your accounts will migrate and be linked together by your email address. Read Logging in to isolved is getting easier! to answer any questions you may have about what this means to you and your employees, including:

- Everything you need to know about Identity-related enhancements that are part of this release:

- Forgot Password

- Reset ESS Login

- Employee Self-Service account activation

- Changes to the process for creating and maintaining client administrators in isolved

- Links to isolved University articles

- FAQs

Usability

More employee screens get the modern look and grid style

As a continuation of the isolved screen design refresh, more screens have been updated with the modern look and new grid style. The overall functionality remains the same but they’re easier to navigate. The new screen designs include:

- Columns you can drag to reorganize and click to sort

- Filters on each column so you can group records or limit your view to find just the information you need

- A Search field to easily find specific records

- An XLSX button to quickly export your current view to Microsoft Excel

- Employee grid views include a Field Chooser to add additional columns of information to review your employee populations at a glance

- Employee grid views include Actions buttons or menus on each record that let you add, edit, or delete without having to scroll

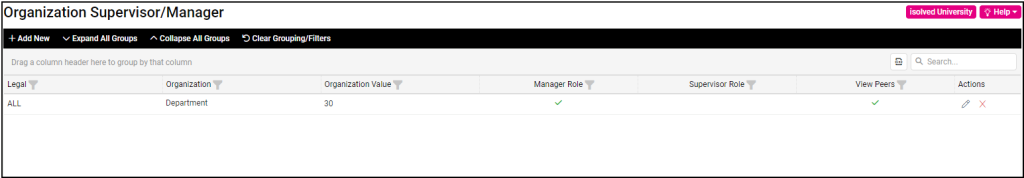

Employee Management screen update

The Organization Supervisor/Manager screen in Employee Maintenance Classic View has been refreshed. Now you can sort, filter, and group employee organization supervisor/manager records and edit using the pencil icon in the Actions column on the right. Use the Search box to find specific records quickly and export your search results to Excel.

The Direct Deposit screen in Employee Management received the same design updates. Navigate to Employee Management > Employee Pay > Direct Deposit to see the new features.

The Direct Deposit screen in Employee Self-Service gets an update

Navigate to Employee Self-Service > Direct Deposit in Classic View to see the updated look.

Onboarding & HR

Temporary COVID-19 Form I-9 accommodations are set to expire

Bring your I-9 processes into compliance before July 31, 2023

Read the Temporary COVID-19 Form I-9 Accommodations Set to Expire article to get ready for the changes to your I-9 verification process.

- U.S. Immigration and Customs Enforcement (ICE) has announced that employers must return to physically inspecting I-9 documents in person by July 31, 2023

- For employees hired between March 20, 2022 and July 31, 2023 when the relaxed inspection requirements were in effect, employers need to go back and physically inspect their documents.

- Learn how to leverage isolved to determine which employees need reinspection and to annotate their I-9s when the inspection is complete

For more information about the changes in the version 9.12 release, contact your Payroll Specialist.